Carmignac Portfolio Merger Arbitrage: Letter from the Fund Managers

Dear investors,

Carmignac Portfolio Merger Arbitrage gained 1.49% (class I shares in EUR) in the third quarter of 2023, driven mainly by an easing of the “antitrust pressure” that had been weighing on some high-profile M&A deals.

The US Federal Trade Commission (FTC) and its UK counterpart, the Competition and Markets Authority (CMA), attempted to block Microsoft’s $69 billion acquisition of Activision in the first half of the year, out of concerns that the merged entity would abuse its dominant position in cloud gaming. The FTC also tried to stop another large merger, this time in the pharmaceutical industry: Amgen’s $28 billion takeover of Horizon Therapeutics. The antitrust regulator was worried that Amgen would bundle its own drugs with the more innovative ones from Horizon Therapeutics, which would essentially close off certain market segments to competition. In the wake of these moves by the FTC, two other M&A deals with competition risk – Globus Medical’s $3.1 billion acquisition of NuVasive and Pfizer’s $43 billion purchase of Seagen – saw their merger arbitrage spreads (or discounts) widen in the second quarter.

When the FTC wants to block a merger or acquisition, it files a lawsuit with a US federal court; the judge then examines each party’s arguments – the FTC on one side and the acquiring company on the other – and makes a decision. In the Activision case, the judge quickly approved the takeover since Microsoft agreed to take specific measures to address the FTC’s concerns about competition in the cloud gaming industry. But in the Horizon Therapeutics case, the FTC had a weaker argument and eventually decided to suspend its lawsuit and negotiate an agreement directly with Amgen. Following these developments in the US, the CMA took the rather unusual step of reversing its decision on the Activision deal and allowing the acquisition by Microsoft to go through.

This was good news for arbitrage traders, and it reduced the spreads on both Activision and Seagen. In addition, the NuVasive and Horizon Therapeutics deals closed in Q3 as expected. These four transactions were the main contributors to our Q3 return, accounting for nearly 40% of the gain.

However, two deals in our portfolio didn’t go through to completion, which dragged on performance. First, MaxLinear pulled out of its bid to acquire Silicon Motion Technology just a few days before the deal was to close because it felt that Silicon Motion hadn’t met its contractual obligations. Second, Intel gave up on its attempted takeover of Tower Semiconductor after Chinese regulators failed to approve the deal before the merger agreement expired. These two transactions trimmed nearly 11% off our Q3 return.

Our return was also impacted, albeit to a lesser extent, by heightened volatility in the spreads on iRobot, Capri Holdings, and JSR during the period.

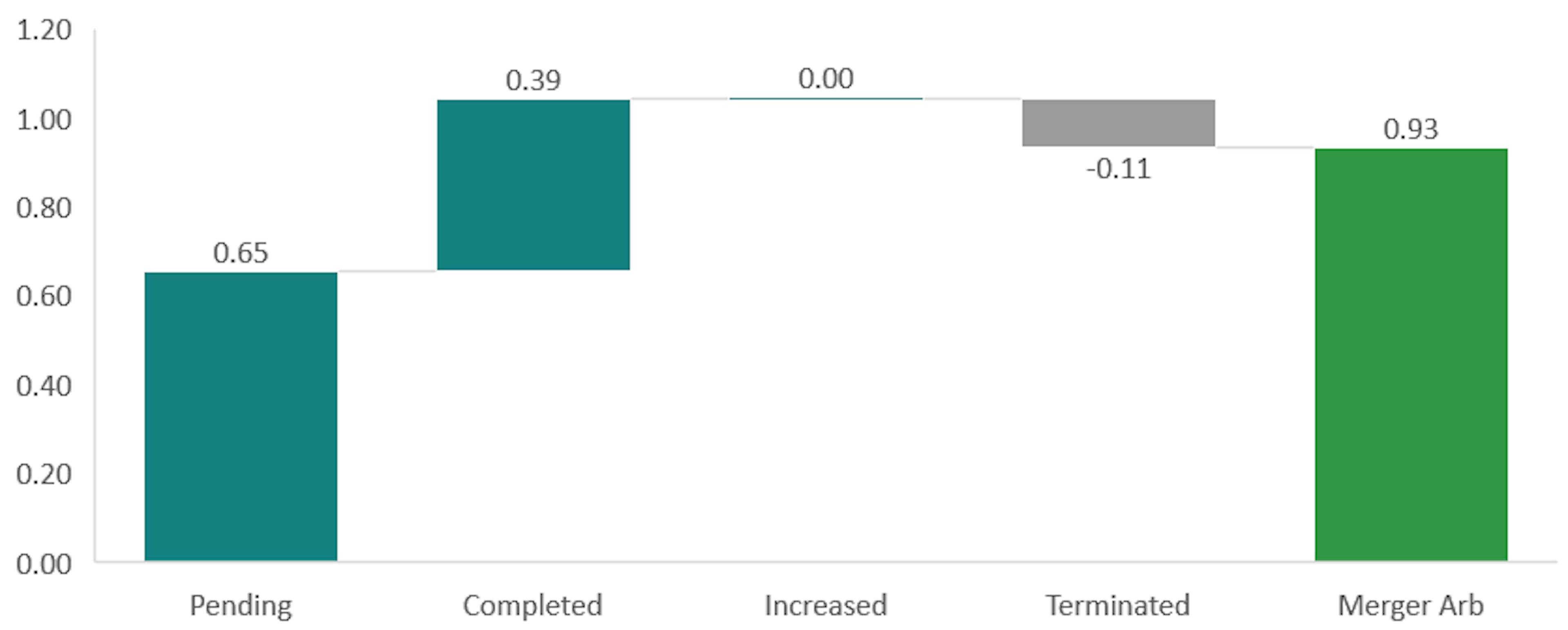

Another way to assess our fund’s performance is to look at where the deals in our portfolio stood at quarter-end. M&A deals can be in one of four phases:

- Pending: The transaction hasn’t yet been completed because certain conditions must still be met .

- Completed: The transaction was carried out under the initial terms.

- Increased: The acquiring company upped its offer price or a third party made a bid at a higher price.

- Terminated: The transaction failed to go through.

The following chart shows our fund’s performance according to this metric:

Carmignac Portfolio Merger Arbitrage performance attribution – Q3 2023

The tighter spreads on pending deals such as Activision and Seagen (first bar on the left) lifted our return, as did the completed deals like Horizon Therapeutics and NuVasive (second bar from the left). The fourth bar corresponds to the two deals that were terminated: Silicon Motion and Tower Semiconductor. Regarding the third bar, deals with increased bids made a zero contribution to our return, as the current market climate isn’t conducive to bidding wars.

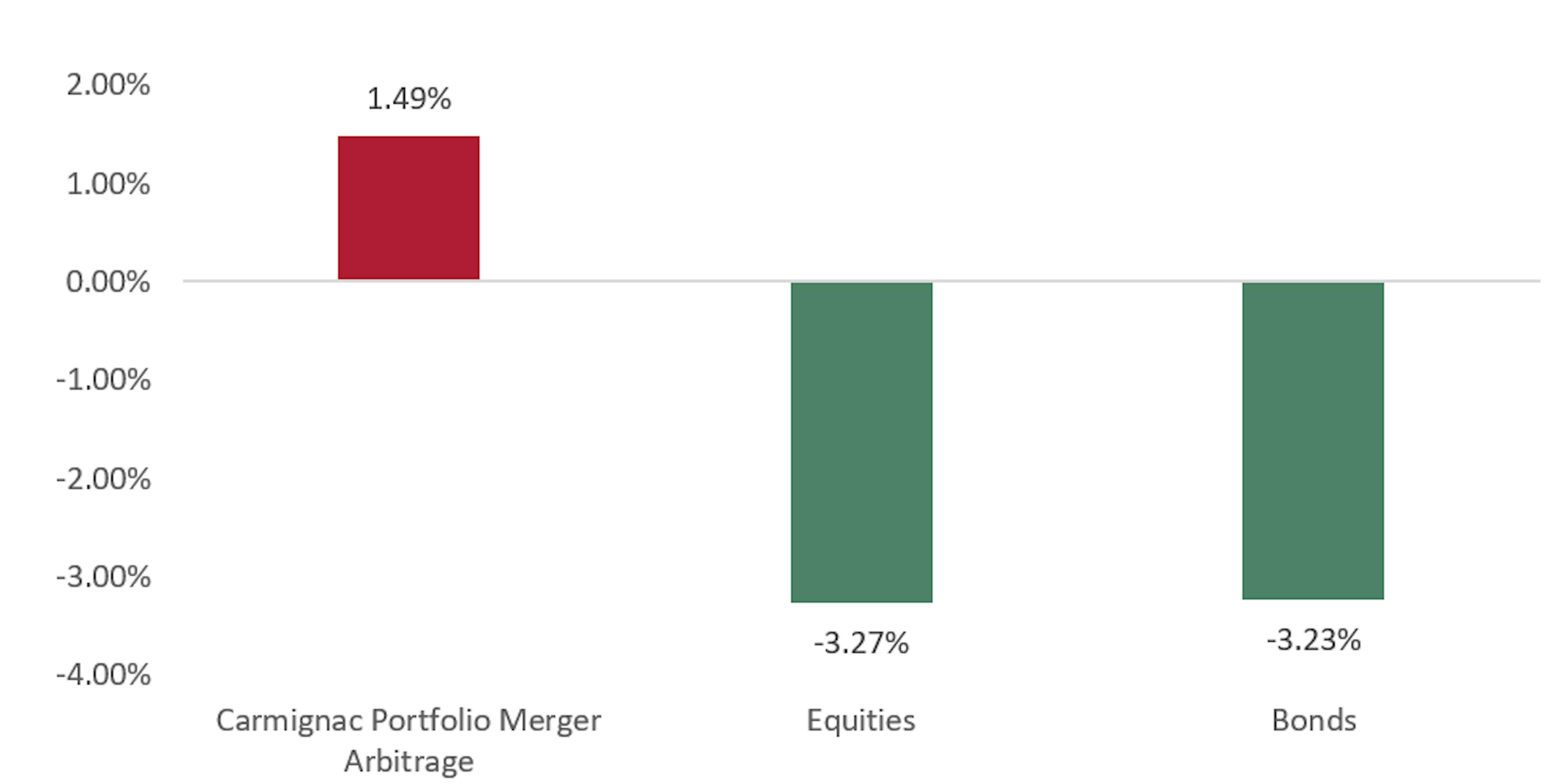

One final highlight of Q3 is that our fund’s performance was uncorrelated with both equities and bonds. We generated a positive return at a time when both those asset classes faced strong headwinds.

Carmignac Portfolio Merger Arbitrage return compared with equities and bonds – Q3 2023

Looking at the overall M&A environment, 66 deals eligible for our portfolio were announced in Q3 in the US, Europe, and Asia – a figure in line with the average over roughly the past four quarters. As usual, the US was the biggest market with 55% of eligible deals, while Europe and Asia accounted for 28% and 17%, respectively. The average deal size in the US was $3.9 billion, against $1.0 billion in both Europe and Asia.

A few things stand out in the regional breakdown for Q3:

- In the US, the healthcare and basic materials sectors made up 41% of the total transaction volume (in USD).

- In Europe, the UK was the biggest market with 41% of the total .

- In Asia, 43% of the deals were in the basic materials sector.

This stream of around 20 deals per month enabled us to regularly replace the transactions that exited our portfolio and keep both our deployed funds rate and our portfolio diversification at levels consistent with our investment objectives.

An interesting trend emerged in Q3, although it remains to be confirmed: a return of large M&A deals (>$10 billion) in the US. In September, two packaging companies – WestRock and Smurfit Kappa – agreed to merge and create a $21 billion industry leader, while Cisco announced it would acquire software developer Splunk for $28 billion.

This trend is probably due to the FTC’s recent failed attempts at blocking mega-mergers in key sectors like technology and healthcare. Now that the “antitrust pressure” has eased, potential acquirers will likely be more confident in launching bids – thus increasing the deal flow. Another large-scale transaction was announced in early October: ExxonMobil’s $60 billion takeover of Pioneer Natural Resources.

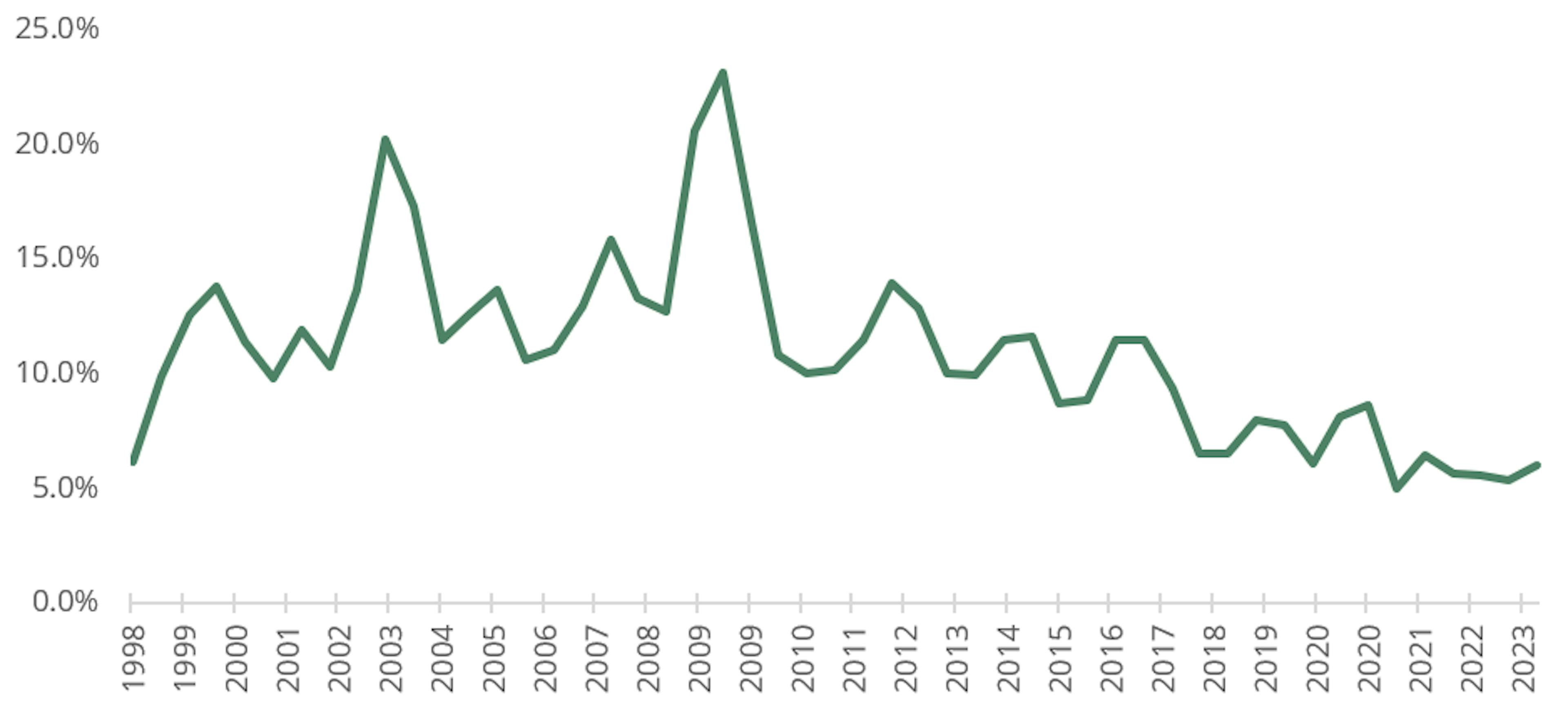

Although two deals in our portfolio were terminated in Q3, the overall deal failure rate in the US is at historically low levels, as shown in the following graph:

M&A deal failure rate in the US over the past 25 years

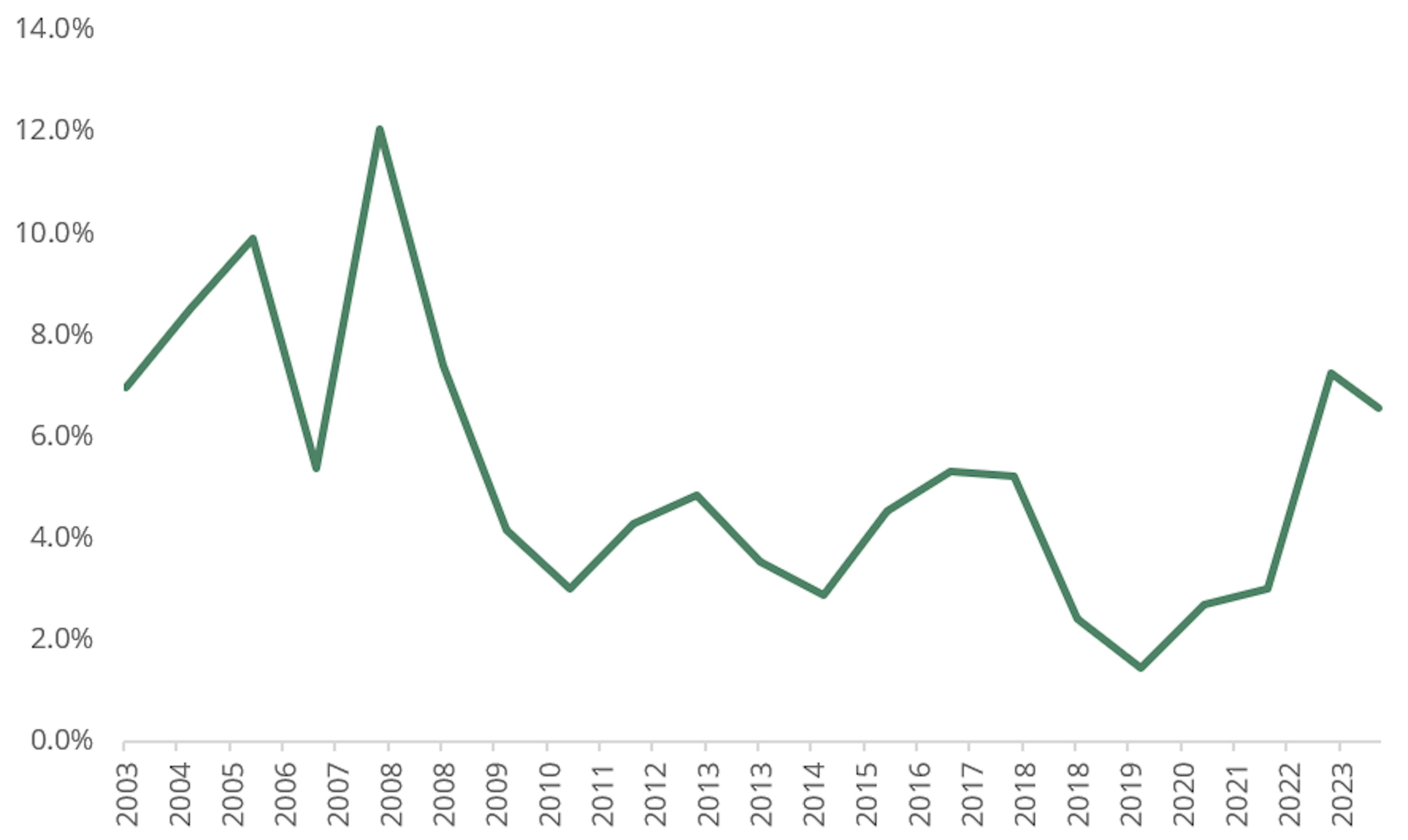

What’s more, merger arbitrage spreads ended Q3 at comfortable levels after getting a boost from the increase in both interest rates and risk premiums starting in 2021, as indicated below:

Average merger arbitrage spreads in the US

In short, we’re highly confident that the M&A climate in the coming quarters will give us numerous opportunities to generate alpha for our investors.

Have a great fall.

The Merger Arbitrage Team

Carmignac Portfolio Merger Arbitrage

A defensive strategy focusing on merger arbitrage opportunitiesRelated articles

Carmignac Portfolio Merger Arbitrage Plus: Letter from the Fund Managers

Carmignac Portfolio Long Short European Equities: Letter from the Fund Manager

Carmignac Portfolio Merger Arbitrage Plus: Letter from the Fund Managers

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.