![[Main Media] [Carmignac Note]](https://carmignac.imgix.net/uploads/article/0001/03/%5BMain-Media%5D-Carmignac%27s-Note_Market_Analysis.jpg?auto=format%2Ccompress&crop=faces&fit=crop&w=3840)

Deciphering financial markets in 2020

January 2020

A good place to start before thinking through investment prospects for 2020 is a clear understanding of how financial markets got to where they are today. What exactly were the dynamics at work up until the last few months? They resulted, as usual, from the combined impact of three key drivers: a shifting economic landscape, investor sentiment – which can pivot from exuberance to panic and back, as revealed by the positions investors take – and changes in available liquidity.

The economic landscape has been characterised over the past decade by what are by and large low, but positive growth rates. The world economy has been struggling to recover from the meltdown in 2008, and then from the 2011 crisis in Europe, with mini-upturns interspersed along the way. For example, there was a brief upturn in 2012–2013, followed by a downturn in 2014–2015, which then gave way to another short upturn in 2016–2017 – before the slowdown we’ve just experienced in 2018–2019. The crucial economic question at this stage is whether we’ll be seeing yet another mini-upswing in 2020 or a continuation of the slowdown.

Investor sentiment over this period obviously reflected how investors perceived those mini-upturns and the implications of monetary policy, but it also moved in response to sharp spikes in political uncertainty. In fact, the first trade-war salvos fired by Donald Trump, combined with the mounting risk of a no-deal Brexit, triggered a mood of panic in the investment community towards the end of 2018. That mood started to subside in 2019 with the end of monetary policy tightening. But it didn’t really fade away and turn into euphoria until the end of the year, when the US Federal Reserve effectively returned to quantitative easing, the UK cleared the decks for a coordinated exit from the European Union and news broke of an imminent first phase of a trade agreement between China and the US. The big question in 2020 is what might impel investors to shift out of their current positioning.

Lastly, monetary policy – meaning how much liquidity gets pumped into the system – has on the whole remained highly dovish over the past decade. However, the changes it underwent shaped the mini-upturns we mentioned earlier and had a decisive impact on market movements. The more hawkish policy that the Fed kicked off in 2018 – despite the first signs of a slowing global economy – thus accelerated the slowdown. It even conjured up recession fears that spelled bad news for equity markets. Conversely, the Fed’s decision in early 2019 to ditch its tightening agenda was a major driver of a stock-market rally that gained increasing traction as the months went by – and that emboldened investors to ignore the fact that corporate earnings growth on both sides of the Atlantic was close to nil. In 2020, any policy shifts by central banks, particularly the Fed after its unconditional surrender last year, will be of paramount importance.

Taken together, these three drivers of financial market movements – the economic landscape, investor sentiment and liquidity – suggest that markets in 2020 could still be trending upwards, but most likely with a number of jolts along the way.

Headwinds to a cyclical upswing

It’s in China where we currently see an expanding range of equity investment opportunities

The economic data available to us as the new year gets going bear out our belief that the two primary global growth engines – China and the United States – are still sputtering.

In China, the domestic economic indicators released in December (PMI readings and their components) still point to a moderate slowdown in the service sector and a more significant one in the construction industry. Capital spending plans still look unimpressive and the harbingers of rising corporate profits are fading from view. At this stage though, we can’t really speak of a downturn. We are dealing rather with a mild levelling off in China’s economic growth rate. That rate should be substantial enough to encourage Asian and European companies to restock in the short term, but too weak to be able to kick-start a lasting global upswing. This isn’t really surprising. The stimulus policies currently pursued by Beijing are much less vigorous than the ones implemented in 2016 to juice the economy. This time around, both the central government and the People’s Bank of China have said no to kicking the can down the road. Neither massive fiscal spending nor a western-style monetary policy is on the agenda. Xi Jinping views stemming the surge in private-sector leverage and getting capital flows under control as strategic issues that take precedence over economic stimulus. The trade agreement with the United States will likely help the government achieve those goals and bring support to the renminbi. China is in fact where we currently see an expanding range of equity investment opportunities.

In the United States, the financial sector has enough weight in the economy to guarantee that last year’s powerful rally in the S&P 500 (engineered to a large extent by the Fed) will lift sentiment further and support consumer spending, an essential contributor to GDP growth. Buttressed by some degree of restocking, this should suffice to give the US economy more positive momentum at the start of 2020. But the attendant wealth effect won’t raise the country’s growth potential, which in our view is 2% at most, due to insufficient productivity gains. As in China, the economic indicators released at the start of the new year point to persistent weakness in US manufacturing (the ISM Manufacturing Index slid further from 48.1 in November to 47.2 in December). That weakness is thus now in danger of spreading to the service sector, which has so far held up well. A favourable comparison basis and the receding risk of trade-war escalation should enable global manufacturing output to steady, or even pick up mildly. But we feel that this is still a far cry from the growth spurt we saw in 2016 and 2017.

In Europe, the economy stands to benefit, in the short run, from the overall improvement we expect but is unlikely to score significant gains on such a modest uptick. (At 46.3 in December, the Markit Eurozone Manufacturing PMI was still stuck in recession territory.) This outlook encourages us to keep our equity portfolios overweight growth stocks with predictable earnings prospects (see our December Note,

“Why we maintain a conviction-based approach to investment” )

The bewildered investor

Just as monetary policy support and the diminishing likelihood of disaster scenarios playing out began to rekindle investor appetite for equities, the Trump administration has created a new front of uncertainty in the Middle East, based on a political calculus that is anything but risk-free. At the same time, the United Kingdom and the European Union will be initiating tough trade talks and the US and China will be entering the second leg of theirs. Moreover, the upcoming US primaries will soon tell us who will be running against Donald Trump for President in November – a crucial variable for financial markets. This makes it likely that the improved investor sentiment that so largely contributed to last year’s market rally will be put to the test several times in 2020. We expect skilful management of portfolio beta – i.e., the risk arising from a portfolio’s exposure to overall market movements – to play a greater role in generating performance than in 2019.

Central banks caught between interventionism and moral hazard

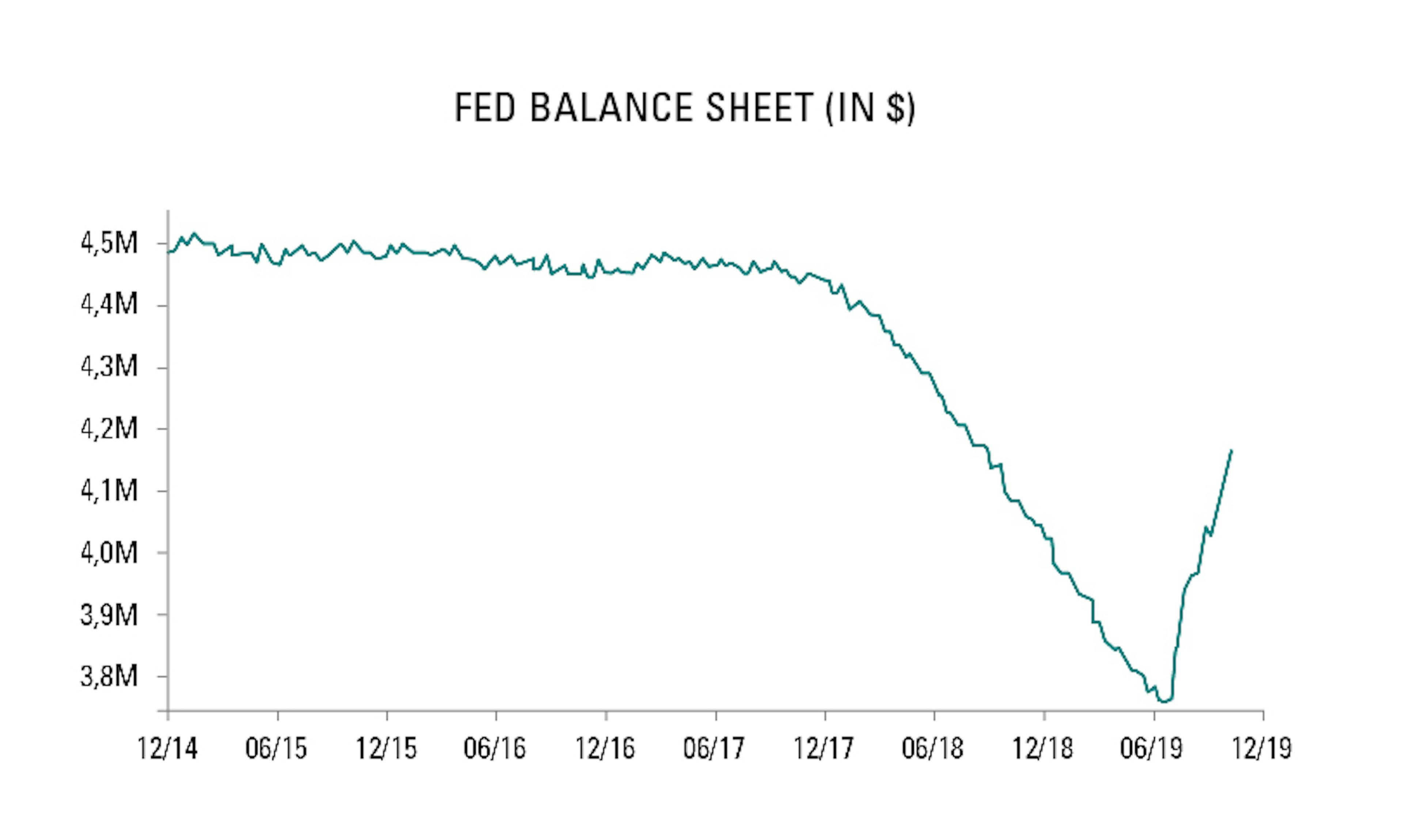

In addition to the ECB’s resumption of its asset purchase programme, the main central-bank highlight of 2019 was the extraordinary interventionism displayed by the Fed. By buying Treasury bills, the central bank has injected over $400 billion into the US economy since September – expanding its balance sheet at roughly the same pace as at the height of the financial crisis some seven or eight years ago. Call it what you like, this marks a de facto return to quantitative easing. It took less than four months to undo half of the monetary policy tightening carried out since early 2018.

The technical circumstances that prompted the Fed to intervene so massively in US interbank lending are complex. But they are clearly related to the insufficient reserves on US bank balance sheets in relation to regulatory requirements at a time when the US Treasury needs to issue enough bonds to finance a deficit in excess of $1 trillion, and when the greenback’s resilience gives foreign investors little incentive to buy US debt. One of the keys to how financial markets will shape up in 2020 is therefore whether this colossal injection of liquidity will continue, or not.

This underscores the tremendous importance of the conclusions the Fed will draw from its 2019 strategic monetary policy review, which should be made public in the first part of 2020. The Fed certainly doesn’t want to relinquish its claim to independence by openly agreeing to monetise – i.e., directly finance – the surge in US government debt caused by the Trump administration’s fiscal policy. But these past two years have driven home a key point to even the most sceptical observers: it is technically impossible for the Fed to scale back its support for financial markets without creating major turmoil. Furthermore, with inflation expectations still low, the US central bank retains considerable leeway for further action. In 2020, the challenge of maintaining an increasingly precarious balance between active intervention and the desire to avoid accusations of moral hazard will likely emerge as a more pressing issue – one that could well prove damaging to the greenback. We have already factored in that risk, as demonstrated by the forex hedges we have set up over the past several months on our dollar-denominated assets.

Conclusion

Our analysis leads us today to believe that the interplay among these three key drivers of market movements will produce much less binary outcomes in 2020 than in the preceding two years. 2018 began with highly upbeat positioning by investors, who were oblivious to how dangerous the announced shift to tighter monetary policy would be for slowing economies. Then, by the start of 2019, the investment-scene pendulum had swung over to extreme pessimism. This suggested a favourable asymmetry in the market risks at hand – an assumption soon corroborated by the 180° shift in US monetary policy, and then by the decline in political risk.

We are nowhere near such dramatic swings today, but investors are still giddy from the market rally at the end of last year, and thus increasingly vulnerable to missteps by policymakers, including – but not limited to – those at central banks. We therefore maintain that in contrast to 2019, this year investors would be wiser to follow a truly active asset management approach as opposed to a trend-based one.

Source: Carmignac, Bloomberg, 31/12/2019

Related articles

![[Management Team] [Author] Saint-Georges Didier](https://carmignac.imgix.net/uploads/NextImage/0001/18/af078dd0ec756626f5340a57acf4f377099528fc.jpeg?auto=format%2Ccompress&fit=fill&w=3840)