Latin America: a fresh start?

Following a recent research trip, Xavier Hovasse, Fund Manager and Head of Emerging Equities, retains conviction that the region can drive returns for the wider EM equity asset class.

Home to 650 million people and 20 countries, Latin America is a vast universe with a market cap of more than 2 trillion USD and 4,000 companies.

Since 2010, the region has been neglected by investors due to economic and political upheaval. At the beginning of this decade, Brazil suffered its worst recession, while Argentina has seen debt restructuring after defaulting on its international sovereign bonds. Questions around investing in the region continued to be raised with cabinet reshuffles and an impeachment vote in Peru, the victory of a far-right candidate in Chile and the swings from right to left in Brazil.

However, from 2022, the region experienced a turnaround, as it started to become a beneficiary from changing geopolitical landscape. Indeed, as a major exporter of commodities, Latin American producers have had a significant opportunity, serving as a new resource for importer countries at a time when war paralysed Ukraine and froze Russian operations. The region also benefitted from the nearshoring phenomenon, with the relocation of supply chains back to the region.

In 2023, Latin America was a bright spot in a somewhat lacklustre year for emerging markets, with the region’s equity markets among the world’s strongest performers. Despite Latin American equity markets historically depending on the strength of Chinese growth and commodity prices, the region outperformed in 2023, notwithstanding the underperformance of the Chinese economy and falling prices within oil and agriculture. We believe that recent economic and geopolitical structural tailwinds that have provided support for the region, will continue in the coming months and quarters.

After a difficult decade, a fresh and stronger start?

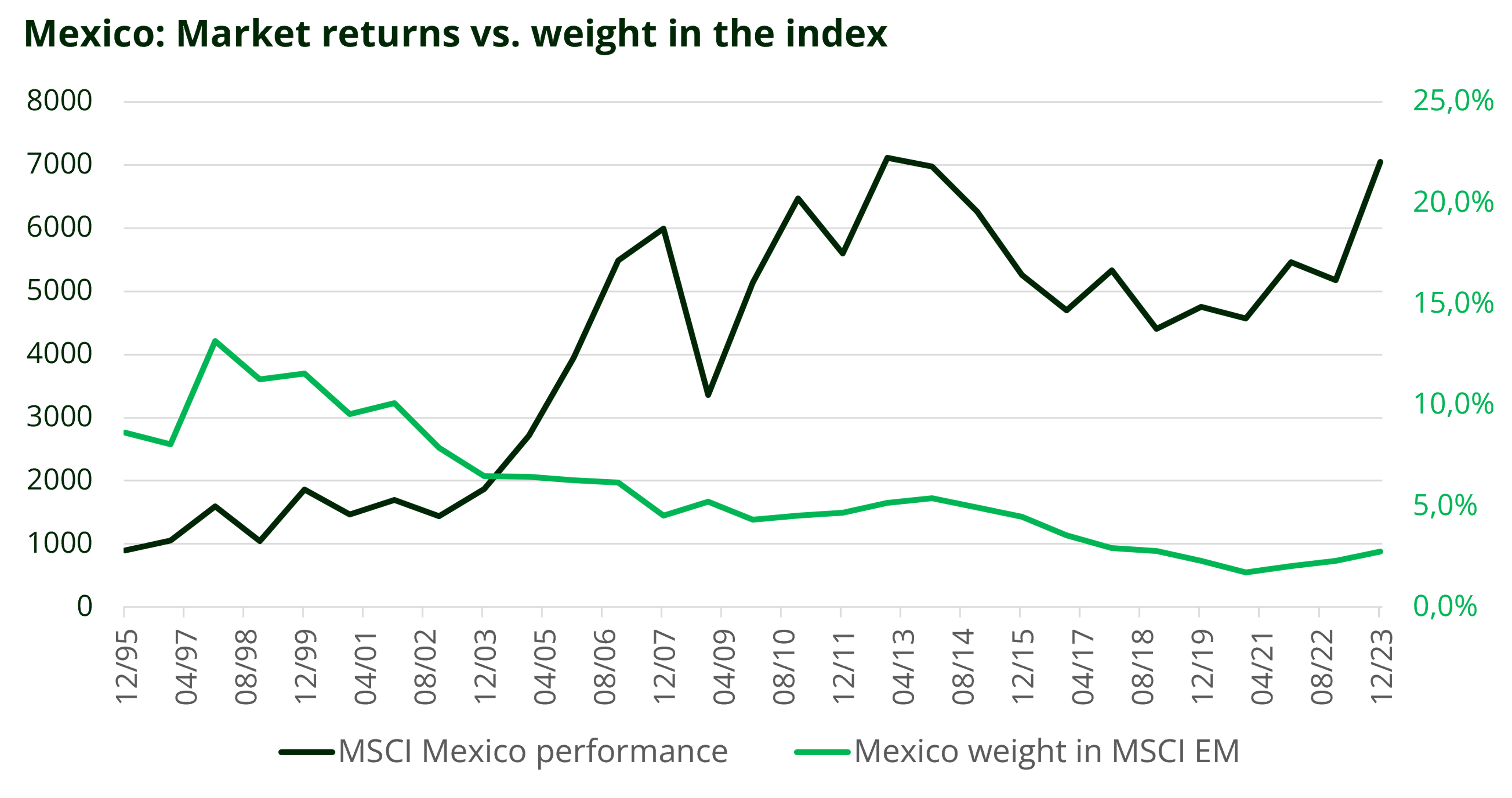

The MSCI Latin America Index returned 25.1% in US dollar terms1, slightly outperforming the MSCI World, which gained just over 24%. Broader emerging markets, as measured by the MSCI Emerging Markets Index returned less than 9.8%, impacted by subdued economic growth in China and capital outflows in context attractive cash rates in the developed markets. Much of Latin America’s strength came from Mexico, with the MSCI Mexico Index up 41.5% in 2023, followed by Brazil which is up 33.4%.

We believe there are three main drivers for strong performance in the region:

A favorable economic backdrop

Despite countries such as Argentina hitting headlines due to triple-digit inflation (254% as of Jan. 20242), inflation in the wider region has been moderating. Many of the region’s central bankers got an aggressive head start on monetary tightening during the Covid 19 pandemic. As a result, inflation in Latin America peaked at 24% in March 2023 and has since fallen to 2021 levels. This early start gives policymakers runway to start, or continue, monetary easing to support their economy - a likely boon for Latin American stocks.

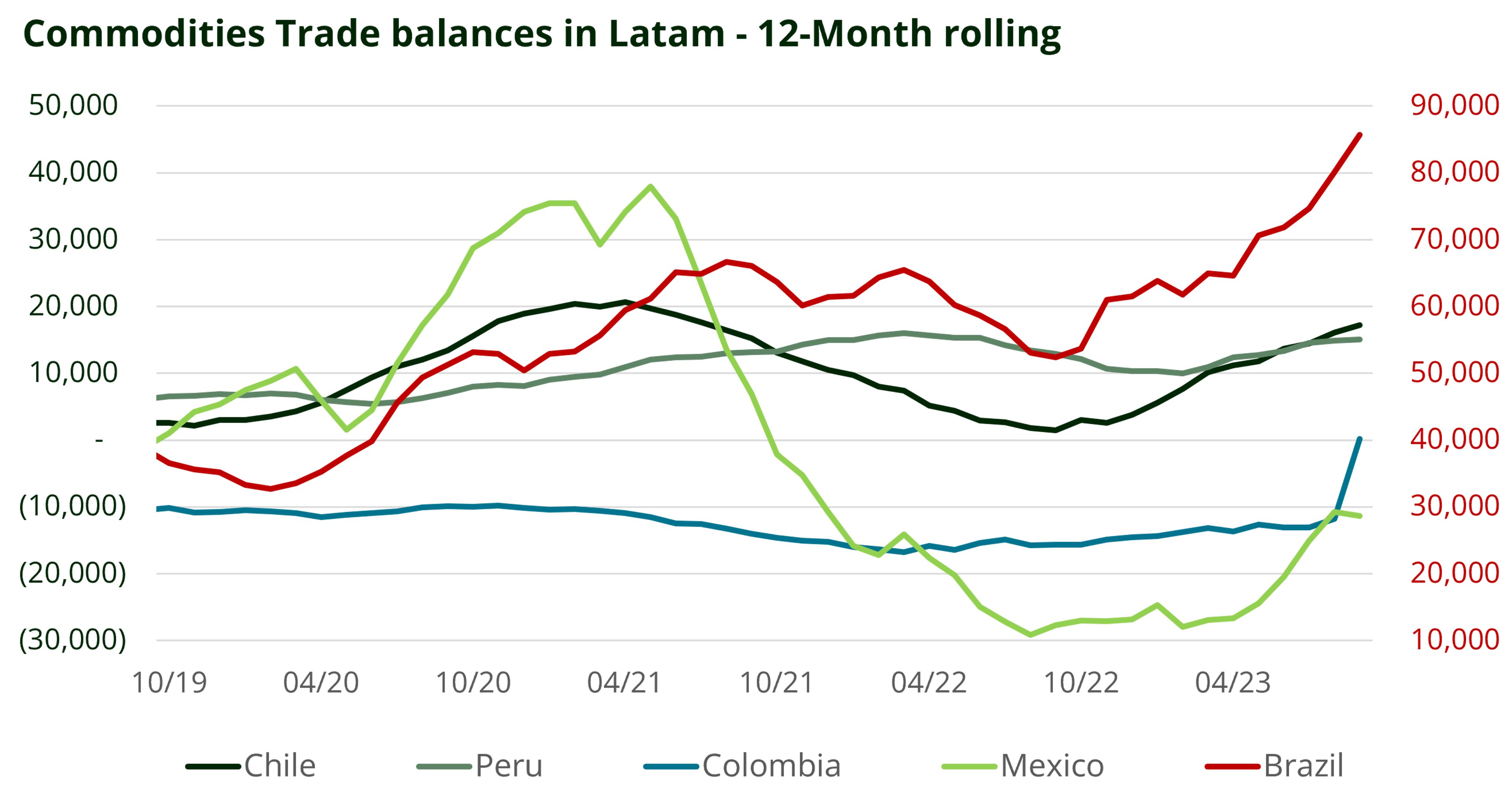

Moreover, after a decade of king dollar, the greenback may lose some of its momentum. And beyond the strength of the dollar index, with solid export activity and the price of exports rising, the terms of trade of Latin American countries are improving, leading to improvements in their trade balances. This should support their currencies versus the US dollar.

Benign political environment

For the first time in a long period, the region is experiencing a less concerning political environment and increasingly muted political risk. In most countries, elections are now behind us, most notably Brazil and Argentina. In Brazil, concerns over left-wing president Lula Da Silva abated as the centre-right Congress implemented checks and balances to ensure the previous finance minister, Paulo Guedes’s orthodox monetary policy continued.

In Argentina, the victory of Javier Milei was welcomed by markets, with the hope of more restrictive policies and budget cuts that should improve the country’s economic fundamentals. We see Argentina as a potential turnaround story if Milei succeeds in stabilizing the economy (inflation under control and lift the currency controls). However, given the challenges the country is facing, we believe is it too early to have a clear view on the country to build our exposure yet, so the country remains on our watchlist.

As for Mexico, we now have visibility of the two leading candidates for the 2024 presidential election. The favourite to win is Claudia Sheinbaum, head of the incumbent Morena party. Her campaign is based on continuing the path set by current president, Lopez Obrador, who has been remarkably orthodox in his fiscal and monetary policies. The other leading candidate is Xochitl Galvez, who comes from a centre-right alliance that’s considered pro-free-market. Both contenders are fully aware that the geopolitical tensions between the US and China are throwing up major opportunities for Mexico, such as near-shoring (discussed in further detail below) and are likely to want to capitalise on these.

Attractive valuations in absolute terms and relative terms

Latin American stocks are currently trading at attractive levels, both historically and compared to global peers, and this even factoring in their recent strong operational performance. Latin America’s 12-month forward price-earnings (P/E) ratio, at 9.0x, is just off its lowest level since 2008 and compares favourably with both the broader MSCI EM Index’s average of 11.4x and the S&P 500 Index’s 20.3x3.

Our view is that Latin American stocks are poised to outperform EM stocks more broadly due to the combination of attractive valuations, a supportive economic backdrop and a benign political environment.

Bright spots in Brazil and Mexico

We see stand-out opportunities in Mexico and Brazil

Mexico - the uncontested beneficiary of nearshoring and relocalisation trends

Mexico has emerged as a significant winner of the geopolitical tensions between the United States and China. Over the long-term, we believe the “nearshoring” trend, which drives global businesses to move supply chains closer to home, could substantially boost US investments in Mexico. The proportion of investments in the economy has risen from 16% to 24% over the past five years, with more than US$11 billion of announced FDI plans according to IMF4, generally related to the automobile sector, electric vehicles (EV) and batteries, circuits, and automation, ensuring strong growth from which the equity market is benefiting.

Over the next five years we believe that Mexico could see a US$155 billion surge in exports to the US—or more than 10% of the country’s GDP.

Lopez Obrador's Morena party has also shown a surprising degree of economic pragmatism which we believe will continue with the next president.

Investment cases

Opportunities in the financial and real estate sector

Nearshoring and the increasing Foreign Direct Investments (FDI) into the Mexican economy is leading to attractive opportunities.

We have exposure to the banking sectors that is a good proxy to economic growth, through our position on the well-established and well capitalised Bank Grupo Banorte. Mexico’s banking penetration is particularly low (as measured by bank loans to GDP) so the overall sector has potential to grow healthily for a long period of time. Over the past 10 years we have been invested in the company, Banorte’s has over-delivered on earnings, cost control and risk management. Their good execution is illustrated by their efficiency ratio at 34%, and their digital transformation with the creation of the digital bank Bineo. Trading at 1.7x book value, 7.9x earnings and 8% dividend yield, Banorte has an attractive valuation even after a 54% rally in 2023 (in USD).

In the real estate sector, we have a position in Inmobiliaria Vesta5 that enables us to fully and directly take advantage of the nearshoring trend. Vesta operates in the highly lucrative market of industrial real estate. US multinationals, in particular, are increasing their production capacity in Mexico in order to diversify away from China and to take advantage of close proximity to the US, cheap natural gas from Texas, and labour costs that are more competitive than those in China. Vesta owns real estate mainly in manufacturing but also in warehousing – with Mercado Libre, Amazon, Safran, Nestlé, Nissan among its customers – meaning it’s also poised to gain from the boom in online retail. What’s more, Vesta has among the best corporate governance and capital allocation policy in its sector.

Within our flagship Global EM Equity strategies, Carmignac Emergents and FP Carmignac Emerging Markets, our exposure to Mexico stands at 10% (as of 31/01/2024), with a clear overweight positioning versus our reference indicator and the broader MSCI EM index.

Brazil - a promising market

The Brazilian economy is demonstrably reaping the benefits of Bolsonaro and Guedes’s reforms, most notably on the labour market, with the privatisation of some of the giants of the Brazilian economy.

Orthodox economic policy, which entailed the Brazilian central bank starting to hike interest rates as soon as March 2021, much earlier than the Fed or the European Central Bank (the ECB), has resulted in the country’s inflation rate falling sharply (the headline consumer price index in the country went from a 27-year high of 12.1% in April 2022 to 4.6% in December 2023, within the central bank inflation target. This shift allowed the central bank to reverse its monetary policy, returning to easing mode which was a welcome development for equity markets.

Moreover6, as a major commodities exporter - 30% of global iron ore, second biggest exporter of raw sugar, soybeans, coffee corn and poultry meat - the Brazilian economy is benefiting from the improvement of agricultural and oil production which have risen sharply as a result of the high levels of investment over the last fifteen years. Agriculture growth is a boon to the economy, and a far more powerful structural driver than generally perceived. The sector accounts for 8% of GDP directly, but indirectly impacts 30% of GDP. Private entrepreneurs have invested a lot in technology, increasing yields by 3% per year over the past 30 years, doubling the average of other countries. With two harvests per year, sometimes even three, Brazilian agriculture is very competitive and provides a boost to economic growth.

As for oil, Brazil currently produces three million barrels of oil equivalent per day, but production is expected to exceed five million by 2029, which will provide significant support for Brazil's balance of payments, and therefore for its currency, the Brazilian real. The record high 90 bln$ trade surplus of 2023 should remain in 2024.

We believe these economic tailwinds in the agricultural and oil sectors are likely to drive robust expansion in trade for Brazil and boost Brazilian equities, which currently trade at a deep discount.

Investment cases

Opportunities in the infrastructure sector

We particularly like the utilities sector in Brazil, a country with strong infrastructure needs, offering investors attractive growth prospects. We invested in Eletrobras7, Brazil’s largest power utility company. 98% of the electricity they produce comes from renewable sources with a mix of hydroelectricity, wind and solar, making the company one of world’s biggest power utility providers. Eletrobras has a solid corporate governance after the changes made during the privatisation of the company. Moreover, the company has an attractive valuation. The real yield on Brazilian sovereign bonds is over 6%, and these utilities companies offer on top of the Brazilian sovereign 3% equity risk premium – therefore offering overall close to 9% real yield for Eletrobras.

Despite a vast majority of renewable companies suffering from a series of headwinds from high interest rates to supply chain issues, Eletrobras ended the year in positive territory. Indeed, the company benefitted from the improvements of its domestic economy and the Brazilian Central Bank bringing inflation under control. The case for Eletrobras illustrates the desynchronisation of economic cycles across different regions, providing investors with diversification opportunities.

Carmignac Emergents and FP Carmignac Emerging Markets’ geographical exposure to Brazil is 12% (as of 31 January 2024).

Conclusion

Latin American stock exposures are under owned weighted in global portfolios.

As things stand, we believe investors should reassess their exposure to opportunities within the region, especially within Brazil and Mexico.

For example8, the Mexican equity market is at an all-time high, whereas its weighting in the MSCI Emerging Markets index is at an all-time low (2.7%). This is a great illustration that indices are late to reflect the changes that we see in emerging markets.

The region provides fertile ground for building concentrated high-conviction portfolios for active stock pickers looking for promising growth prospects like Carmignac.

Our outlook on Latin America is positive and we intend to continue shoring up our investments in the region (buying the dips) as we believe Latin America stands to benefit from structural trends, including the relocation of production plants to North America, and economic tailwinds, such as sustained commodities demand. The region also stands to benefit from the clean energy revolution, as the it is among the biggest producers of green metals that are key for renewable technologies. As it stands, we have increased our regional exposure to more than 22% in our EM Equity portfolios. This is our highest LatAm exposure within the past eight years, with an overweight positioning versus the global EM equity indices (9% in the MSCI EM index9).

Investing in Latin America also enables us to diversify investments away from tech-heavy Asia and China; a valuable feature in periods of high interest rates and geopolitical uncertainty. As it allows for quality cyclical exposure avoiding the typical factor biases that may be attached to traditional ESG portfolios.

In a fast-changing and complex universe such as emerging markets, we believe it is even more crucial to invest via actively managed strategies in order to exploit the market inefficiencies and have exposure to the most attractive part of the universe while avoiding the unsustainable companies.

2Year-on-year figure.

3Source : Bloomberg, as of 31/01/2024. The portfolios of Carmignac Funds are subject to change without notice.

4Source: IMF, Mexico 2023 ARTICLE IV consultation, November 2023.

5The portfolios of Carmignac Funds are subject to change without notice.

6Source: Bloomberg, IMF, OECD, 31/12/2023.

7The portfolios of Carmignac Funds are subject to change without notice.

8Source : MSCI data, Bloomberg, 31/12/2023.

9Source : Bloomberg, 31/12/2023.

Carmignac Portfolio Emergents FW GBP Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 6/7

- SFDR - Fund Classification**

- Article 9

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0,00%

- Redemption Fees

- 0,00%

- Conversion Fee

-

- Ongoing Charges

- 1.35%

- Management Fees

- 1,05% MAX

- Performance Fees

-

Footnote

Related articles

FP Carmignac Emerging Markets: A recognised long-term expertise in emerging markets

Our Fund Managers awarded for excellence

Marketing Communication. Document completed on 26/02/2024. Please refer to the KID/prospectus of the fund before making any final investment decisions. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in French, English, German, Dutch, Spanish, Italian on the Carmignac website, regulatory information section, at § 6 entitled "summary of investor rights. This document is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF), pursuant to section 15 of the Luxembourg Law of 17 December 2010. “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark. This document does not constitute advice on any investment or arbitrage of transferable securities or any other asset management or investment product or service. The information and opinions contained in this document do not consider investors’ specific individual circumstances and must never be interpreted as legal, tax or investment advice. Past performance is not a reliable indicator of future returns. The portfolios of Carmignac funds are subject to change without notice. The information contained in this document may be partial and could be changed without notice. This document may not be reproduced in whole or in part without prior authorisation. The risks, fees and ongoing charges are described in the KID (Key Information Document). The prospectus, KID, the net asset-values and the latest (semi-) annual management report may be obtained, free of charge, in French, English, German, Dutch, Spanish, Italian, from the management company. The subscriber must read the KID before each subscription. The Funds present a risk of loss of capital. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds commun de placement or FCP) are common funds in contractual form (FCP) conforming to the UCITS Directive under French law. Access to the Fund may be subject to restrictions regarding certain persons or countries. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA. Morningstar Rating™: © 2023 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. UK: This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd and is being distributed in the UK by Carmignac Gestion Luxembourg. ". Switzerland: the prospectus, KIIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. Belgium: These materials may also be obtained from Caceis Belgium S.A., the financial service provider, at the following address: avenue du port, 86c b320, B-1000 Brussels. In case of subscription in a French investment fund (fonds commun de placement or FCP), you must declare on tax form, each year, the share of the dividends (and interest, if applicable) received by the Fund. A detailed calculation can be performed at www.carmignac.be. This tool does not constitute tax advice and is intended to serve solely as a calculation aid. This does not exempt from having to perform the procedures and verifications incumbent upon a taxpayer. The results indicated are obtained using data that the taxpayer provide, and under no circumstances shall Carmignac be held responsible in the event of error or omission on your part. Pursuant to Article 19bis of the Belgian Income Tax Code (CIR92), in the case of subscription to a Fund that is subject to the Savings Taxation Directive, the investor will have to pay, upon redemption of his or her shares, a withholding tax of 30% on the income (in the form of interest, or capital gains or losses) derived from the return on assets invested in debt claims. Distributions are subject to withholding tax of 30% without income distinction. The net asset values are available on the website www.fundinfo.com. Any complaint may be referred to complaints@carmignac.com or CARMIGNAC GESTION - Compliance and Internal Controls - 24 place Vendôme Paris France or on the website www.ombudsfin.be.

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35 Investment management company approved by the AMF Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel: (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 549.

![[Management Team] [Author] Hovasse Xavier](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-%5BAuthor%5D-Hovasse-Xavier-1.png?auto=format%2Ccompress&fit=fill&w=3840)