Southeast Asia: A powerhouse in the making

South East (SE) Asia is one of the most exciting regions for investors in the emerging markets universe, with many companies offering attractive and compounding multi-year growth prospects. From Indonesia’s digital economy to Vietnam’s IT services hubs, SE Asia offers opportunities across a broad range of sectors, with hungry entrepreneurs and unique business models.

Revisiting the SE Asia case

With a combined population of over 4.8 billion people, Asia is by far the most populated region on the planet. Even after the 2.8 billion combined population of India and China, SE Asia is still home to a further 700 million people and the continuing demographic trends will continue to drive growth in the region for decades to come.

From a corporate perspective, SE Asia represents currently:

Beyond its size, SE Asia is also emerging as a dynamic economic powerhouse thanks to its robust macroeconomic fundamentals and growth potential. Investors who once saw the region as a proxy for commodities are now discovering its richness in diverse sectors, underpinned by strong economic indicators. Indeed, SE Asian countries posted a GDP growth of 4.6% in 2024, compared with a 1.8% growth for advanced economies according to IMF data2.

Economically, the region continues to move from strength to strength. Many SE Asian countries have in the past decade followed orthodox fiscal policies, reducing deficits, and limiting currency depreciation, successfully addressing their vulnerabilities to produce a favourable investment environment.

From a bottom-up perspective, SE Asia offers fertile ground for stock picking. Many sectors remain underpenetrated, providing room for companies to grow faster than the broader economy. The standout companies in each sector also offer compounding growth, making for compelling long-term investment opportunities for diligent stock pickers like Carmignac.

Indonesia: Sparkling gem of the ASEAN region

As SE Asia’s largest economy, Indonesia has navigated global challenges including trade wars and the pandemic with impressive resilience. Key factors – a young workforce, abundant natural resources, particularly as the largest producer of energy-transition-critical nickel – and fiscal discipline have transformed Indonesia into a robust growth story.

The country’s recent economic achievements are particularly compelling. Inflation has eased significantly since the global 2021-2022 shocks, falling to near-record lows (CPI Inflation standing at 0.8% as of end of January 20256), enabling Bank Indonesia to begin its easing cycle, which should support the Indonesian equity markets going forwards.

Reforms supporting digitisation and future-focused sectors including electric vehicle battery production have further cemented Indonesia’s role in the global economy, in line with emerging mega-trends. Meanwhile, on the political side, following the presidential election last year, there seems to be a smooth transition between the former president Jokowi and the General Prabowo Subianto, bringing some political stability to the country. With the new government’s pro-growth agenda, prospects look solid in Indonesia.

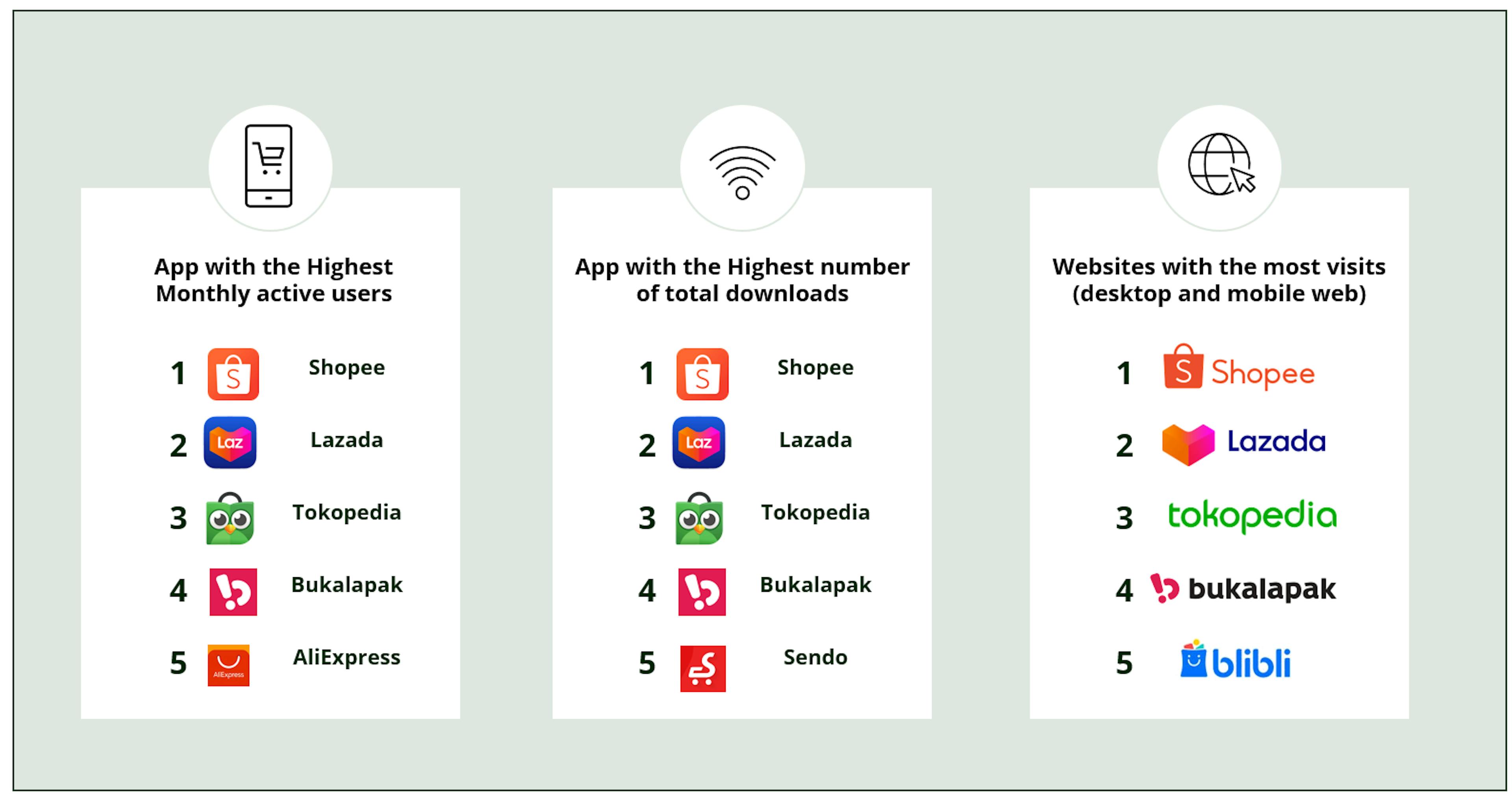

TOP 5 ECOMMERCE PLATFORMS IN SOUTHEAST ASIA IN 2023

Vietnam: A growing global footprint

Vietnam has also ascended as one of SE Asia’s most dynamic economies, becoming the manufacturing hub of the world, taking over from China. Leveraging its position as an alternative trading partner – challenging both China’s manufacturing dominance and India’s IT services exports – Vietnam has made significant strides. After experiencing a challenging period during the pandemic and subsequent export decline, Vietnam has rebounded strongly with record trade surpluses, further securing its reputation as an emerging export powerhouse. In fact, (after the correction of the past years, Vietnamese equities markets now have attractive valuations) these experiences may mean the valuations of some of the country’s most promising companies are particularly attractive.

Domestically, Vietnam’s economy is stabilising, with a resurgence in spending, credit growth and infrastructure development that collectively support its industrial ambitions. Mid-2024, Vietnam recorded the largest external surpluses in its history, at about 7% of GDP. And despite its $400 billion economy and population of 100 million8, Vietnam is absent from global indices, presenting a rare opportunity for active investors looking for growth.

In July 2024, the unexpected death of General Secretary Trong, led to the appointment of President and politburo member To Lam, taking on the acting role of the general secretary. While this new acting general secretary appears to be accumulating almost as much powers as his Chinese counterpart, the implied stability that it brings, combined with his pragmatism and pro-economic growth agenda point to an environment which is very conducive for companies to prosper.

Opportunities in high-growth sectors

When selecting stocks, Carmignac’s EM team looks for companies that offer compounding growth in underpenetrated sectors – two factors where Sea and FPT shine.

We are looking for companies with solid cash flow generation, self-financed growth, and success-hungry management teams, whittling our investment universe of 4000 securities to between 10 to 15 high-conviction selections across Asian large, mid, and small caps.

Carmignac’s strategy is to identify these opportunities early, including by keeping close relationships with private companies in anticipation of their going public to be able to invest during their IPOs.

Whether investing in large-cap companies via our flagship global EM Equity strategy, Carmignac Portfolio Emergents Fund, or in all-cap Emerging Asia companies via Carmignac Portfolio Asia Discovery Fund, our goal remains the same: to uncover compounders capable of sustaining long-term growth, reinvesting the proceeds of their success, while achieving a positive outcome on society or the environment, financing sectors or businesses where there are strong needs.

“We are looking for companies with solid cash flow generation, self-financed growth, and success-hungry management teams.”

Why now? A success story that is set to continue

The ASEAN region is well on track to becoming the fourth-largest economy in the world by 20309. The region benefits from a young, fast-growing population. While many advanced economies are grappling with ageing workforces, SE Asia’s youthful demographic is a competitive edge, forming a tech-savvy middle class that is eager to spend.

Moreover, with global easing cycle continuing and inflation under control in Asia, local central banks can cut rates without jeopardizing their currencies. This is particularly the case for Indonesia and Philippines that had aggressively increased rates with the Federal Reserve tightening and now are cutting rates.

Investment wise, SE Asia markets play an important role in EM portfolios, acting as an effective diversification tool as the region shows low correlation with developed markets and also when compared with other Emerging regions, such as Latin America or India (see chart below).

They also provide a low beta exposure and compelling valuations in absolute and relative terms compared to Taiwan and other North Asian Tech companies.

Finally, in an environment marked by many concerns around the structural outlook for China, SE Asia emerges as an appealing alternative. Not only does it represent a China plus one alternative alongside India, but one with more compelling valuations given the stretched valuations in India following the solid performance of the past years.

MSCI ASEAN CORRELATIONS WITH DEVELOPED AND MAIN EM MARKETS OVER 3 YEARS (IN EUR)10

https://www.cnbc.com/2024/06/24/southeast-asia-is-the-top-choice-for-firms-diversifying-away-from-china.html

https://asia.nikkei.com/Business/Business-Spotlight/Malaysia-aims-for-chip-comeback-as-Intel-Infineon-and-more-pile-in

https://www.thestar.com.my/news/nation/2024/05/28/m039sia-to-become-global-semiconductor-rd-hub-attract-billions-in-investment-says-pm. https://thediplomat.com/2024/01/the-role-of-thailand-in-germanys-auto-manufacturing-future/

https://issuu.com/germanthaichamber/docs/update_q2-2024_pharmaceutical_industry_and_trends/s/46389208

https://foreignpolicy.com/2024/05/08/indonesia-electric-vehicle-green-transition-china-tariffs

5Sources: IMF : https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/WEOWORLD/GUY/SUR/BRA/COL/ADVEC/AS5

6Source : Bloomberg 31/01/2025

7Source: TMO Group Asia, SeekingAlpha Research, Company data, 31/12/2024.

8Source: World Bank, Haver 31/12/2024.

9Source: IMF World Economic Outlook forecasts published on Jan 2025.

10Source: Bloomberg, 31/01/2025.

FP Carmignac Emerging Markets A GBP ACC

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 6/7

- SFDR - Fund Classification

- Article -

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0,00%

- Redemption Fees

- 0,00%

- Conversion Fee

-

- Ongoing Charges

- 0.95%

- Management Fees

- 0,87% MAX

- Performance Fees

-

Footnote

Performance

| FP Carmignac Emerging Markets | 13.6 | 63.0 | -15.6 | -9.5 | 7.2 | 0.9 | 3.8 |

| Reference Indicator | 8.8 | 14.7 | -1.6 | -10.0 | 3.6 | 9.4 | 1.7 |

| FP Carmignac Emerging Markets | + 3.8 % | + 7.9 % | + 8.3 % |

| Reference Indicator | + 2.6 % | + 4.6 % | + 4.3 % |

Source: Carmignac at 28 Feb 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: MSCI EM NR index

Carmignac Portfolio Asia Discovery FW GBP Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 5/7

- SFDR - Fund Classification**

- Article 8

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Maximum subscription fees paid to distributors

- 0,00%

- Redemption Fees

- 0,00%

- Conversion Fee

-

- Ongoing Charges

- 1.50%

- Management Fees

- 1,20% MAX

- Performance Fees

-

Footnote

Performance

| Carmignac Portfolio Asia Discovery | 21.2 | 24.1 | -6.9 | 5.2 | 6.5 | 20.0 | -17.2 | 10.9 | 25.1 | -7.9 |

| Reference Indicator | 23.5 | 22.9 | -10.7 | 8.0 | 11.3 | 13.8 | -6.7 | 12.2 | 4.8 | -6.0 |

| Carmignac Portfolio Asia Discovery | + 7.3 % | + 7.4 % | + 6.9 % |

| Reference Indicator | + 2.7 % | + 7.3 % | + 5.7 % |

Source: Carmignac at 28 Feb 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: 1525_CAREMDS_LX_GBP

Related articles

FP Carmignac Emerging Markets: Letter from the fund manager

Naomi Waistell to join Carmignac EM equities team

Carmignac Portfolio Emerging Discovery: Letter from the Fund Managers

MARKETING COMMUNICATION

Please refer to the KID/prospectus of the fund before making any final investment decisions. This document is intended for professional clients. The decision to invest in the promoted fund should consider all its characteristics or objectives as described in its prospectus. This communication is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF). “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark. This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. Carmignac portfolios are subject to changes without notice. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA. Company. The risks, fees and ongoing charges are described in the KIID/KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds’ prospectus, KIDs, KIIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management Company. Investors have access to a summary of their rights in French, English, German, Dutch, Spanish, Italian at section 5 of "regulatory information page" on the following link: https://www.carmignac.com/en_US/regulatory-information Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law. The Management Company can cease promotion in your country anytime. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the Financial Conduct Authority (the “FCA”) with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, England, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac Gestion SA, an investment management company approved by the AMF and Carmignac UK Ltd (Registered in England and Wales with number 14162894) have been appointed as sub-Investment Managers of the Company. Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager. Morningstar Rating™ : © 2023 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content 7 providers are responsible for any damages or losses arising from any use of this information. Citywire Fund Manager Ratings and Citywire Rankings are proprietary to Citywire Financial Publishers Ltd (“Citywire”) and © Citywire 2022. All rights reserved. Citywire information is proprietary and confidential to Citywire Financial Publishers Ltd (“Citywire”), may not be copied and Citywire excludes any liability arising out its use. Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page. UK: This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd and is being distributed in the UK by Carmignac Gestion Luxembourg. Switzerland: the prospectus, KIIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon. Belgium: These materials may also be obtained from Caceis Belgium S.A., the financial service provider, at the following address: avenue du port, 86c b320, B-1000 Brussels. In case of subscription in a French investment fund (fonds commun de placement or FCP), you must declare on tax form, each year, the share of the dividends (and interest, if applicable) received by the Fund. A detailed calculation can be performed at www.carmignac.be. This tool does not constitute tax advice and is intended to serve solely as a calculation aid. This does not exempt from having to perform the procedures and verifications incumbent upon a taxpayer. The results indicated are obtained using data that the taxpayer provide, and under no circumstances shall Carmignac be held responsible in the event of error or omission on your part. Pursuant to Article 19bis of the Belgian Income Tax Code (CIR92), in the case of subscription to a Fund that is subject to the Savings Taxation Directive, the investor will have to pay, upon redemption of his or her shares, a withholding tax of 30% on the income (in the form of interest, or capital gains or losses) derived from the return on assets invested in debt claims. Distributions are subject to withholding tax of 30% without income distinction. The net asset-values are available on the website www.fundinfo.com. Any complaint may be referred to complaints@carmignac.com or CARMIGNAC GESTION - Compliance and Internal Controls - 24 place Vendôme Paris France or on the website www.ombudsfin.be.

Carmignac Gestion, 24, place Vendôme - 75001 Paris. Investment management company approved by the AMF. Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676.

Carmignac Gestion Luxembourg, City Link - 7, rue de la Chapelle - L-1325 Luxembourg. Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF. Public limited company with share capital of € 23,000,000 - RCS Luxembourg B 67 5.