Investing for tomorrow with FP Carmignac Global Equity Compounders

Why focus on quality stocks?

When considering long-term investments, the notion of a quality company is frequently mentioned. Nevertheless, defining it accurately can prove challenging, and its interpretation may differ among investors. Indeed, no one would claim to invest in poor quality companies. At Carmignac, we strive for the most objective definition possible, based on two key concepts: profitability and the reinvestment of profits for future growth. Convinced that it is our responsibility to create both financial and extra-financial value for our clients and future generations, FP Carmignac Global Equity Compounders aims to seize the potential offered by quality stocks, which we also call Compounders.

FP Carmignac Global Equity Compounders, a fund focused on quality, sustainable companies

FP Carmignac Global Equity Compounders is a global equity fund launched in 2020 with the aim of capturing the performance of Compounders, high-quality stocks, while adopting a sustainable approach.

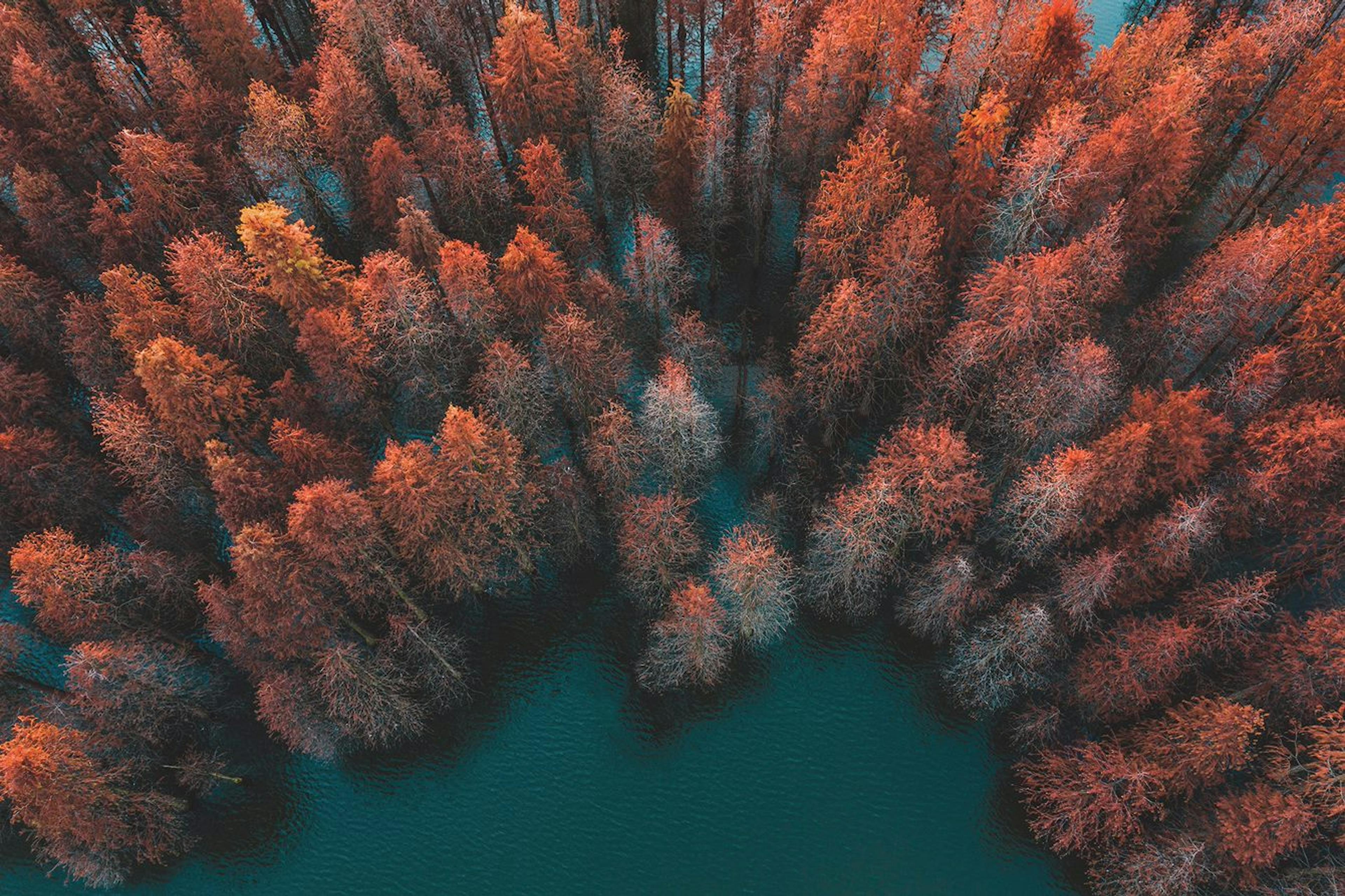

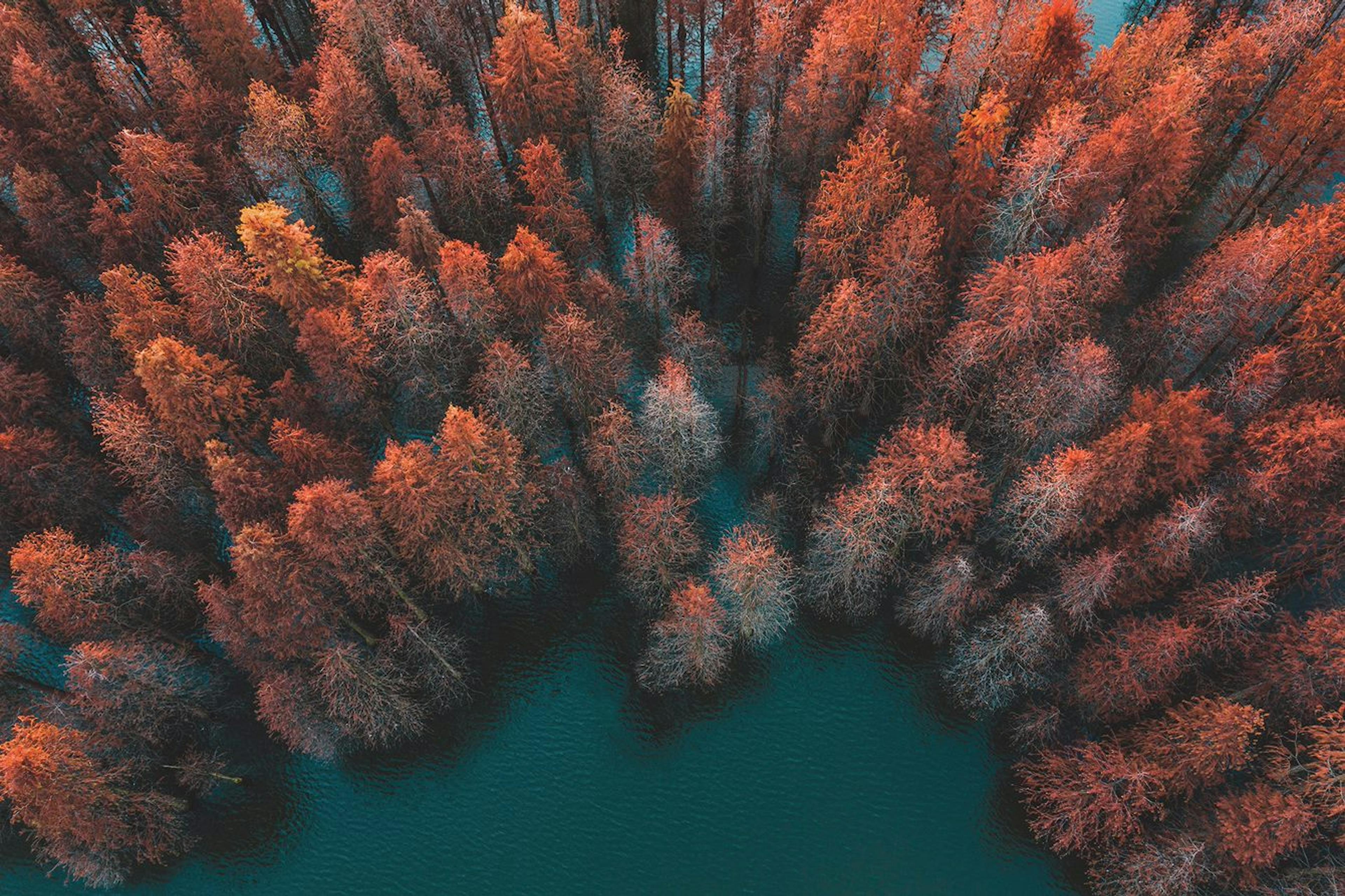

Investing in Compounders reflects the aspiration we share with our clients of preserving and passing on their capital over time. To do this, we identify Compounders, quality companies that are capable of weathering different economic cycles. This adaptability and resilience enable the Fund to achieve its objective of helping investors to accumulate a long-term wealth.

Quality premium: long-term outperformance

An in-depth study of the performance of different management styles is essential to help investors in their investment decisions. Alongside well-known management styles, such as 'growth' and 'value', we have observed that quality companies have been able to hold their own over the last few decades. Their strong fundamentals and innovative abilities often enable them to adapt to market changes and remain competitive. Focusing on these stocks offers investors a valuable alternative for dealing with different market conditions.

Performance of the MSCI World Quality against the MSCI World Growth and MSCI World Value since its inception in 1982:

Carmignac’s specific approach to quality

At Carmignac, we believe that investing in high-quality companies can provide opportunities. To identify them in different market conditions, Mark Denham, head of European equities and fund manager, developed an objective approach more than 20 years ago based on historical data and concrete characteristics.

This investment process has proved its worth. It is based on two specific criteria: high and sustainable profitability, and reinvestment of earnings to support future growth. By reinvesting capital internally rather than paying dividends, these companies create additional growth drivers, through innovation or product development for example, which enables them to grow and last over time. This investment style is implemented in several funds in our range, and particularly in FP Carmignac Global Equity Compounders. This approach demonstrates our commitment to helping investors build sustainable capital that will benefit not only themselves, but also future generations.

However, we think it's important to include non-financial criteria when defining high-quality stocks. At Carmignac, we are convinced that a quality company should have a positive contribution on the environment and society. We believe that companies with high standards in terms of sustainable development can look forward to more promising long-term prospects.

Investing now for tomorrow

The macroeconomic context of recent years has raised queries among investors about the consequences of inflation's resurgence and the sharp increase in interest rates on global economies and businesses. The current economic slowdown is prompting investors to favour quality stocks and sectors - considered by many to be more resilient. These companies are often less indebted and have solid balance sheets. They can therefore continue to finance new projects without incurring excessive debt costs and maintain attractive margins.

We believe that forward-looking sectors offer opportunities, such as healthcare which combines short-term resilience with long-term growth prospects. However, we mustn't lose sight of the fact that for a long-term investor, it's always a good time to invest in quality equities!

Convinced that healthcare and consumer staples are structurally high-quality sectors

Defensive sectors are less sensitive to the different phases of the economic cycle. This is particularly true of healthcare and consumer staples stocks. Innovation is an integral part of the way these sectors operate. The healthcare industry must continually find solutions to the health challenges brought by demographic changes, such as a growing and ageing population, while the consumer sector is regularly confronted with arising needs related to new ways of life.

Novo Nordisk, a century of medical innovation

Within FP Carmignac Global Equity Compounders, we have a strong conviction in Novo Nordisk, a Danish pharmaceutical company. Novo Nordisk reinvests a significant part of its profits in research to develop treatments for the growing number of chronic diseases linked to urban lifestyles. The company is one of the pioneers in the fight against diabetes, introducing insulin to the market in 1923.

Procter&Gamble, a heritage of avant-gardists

Procter&Gamble is an American company in the consumer staples sector. It is another conviction in our portfolio as, since 1837, it has been able to innovate both through its products and its marketing. Whether in the sanitary sector, with the invention of a decongestant ointment in 1894 or a disposable nappy in 1961, or in the household care sector, with softening sheets in 1973 to accompany the growing use of tumble dryers, the company has been able to take advantage of its research and development laboratory to meet the changing needs of households.

We are convinced that, in this uncertain macroeconomic environment, quality companies remain the preferred choice. Using its expertise, FP Carmignac Global Equity Compounders has been able to identify companies that generate long-term profitability. This specific approach of quality investing enables investors to prepare for their own future, as well as that of their progeny.

Key messages

FP Carmignac Global Equity Compounders A GBP ACC

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 6/7

- SFDR - Fund Classification

- Article -

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time.

Main risks of the fund

Performance

| FP Carmignac Global Equity Compounders | 23.1 | 22.6 | -19.0 | 21.0 | 17.6 | -6.5 |

| Reference Indicator | 19.8 | 22.9 | -7.8 | 16.8 | 20.8 | -4.7 |

| FP Carmignac Global Equity Compounders | - 3.7 % | + 6.1 % | + 10.5 % |

| Reference Indicator | + 4.8 % | + 8.3 % | + 13.1 % |

Source: Carmignac at 31 Mar 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: MSCI World NR index

Related articles

FP Carmignac Global Equity Compounders: Letter from the Fund Managers

FP Carmignac Global Equity Compounders: Letter from the Fund Managers

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

In Spain : The Funds are registered with the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores) under the following numbers: Carmignac Sécurité 395, Carmignac Portfolio 392, Carmignac Patrimoine 386, Carmignac Absolute Return Europe 398, Carmignac Investissement 385, Carmignac Emergents 387, Carmignac Credit 2027 2098, Carmignac Credit 2029 2203, Carmignac Credit 2031 2297, Carmignac Court Terme 1111.

The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.