Sustainable bonds: an investment opportunity?

As an active investor who commits to integrate Environmental, Social and Governance (ESG) considerations into our portfolios, Carmignac invests in sustainable bonds.

What are sustainable bonds?

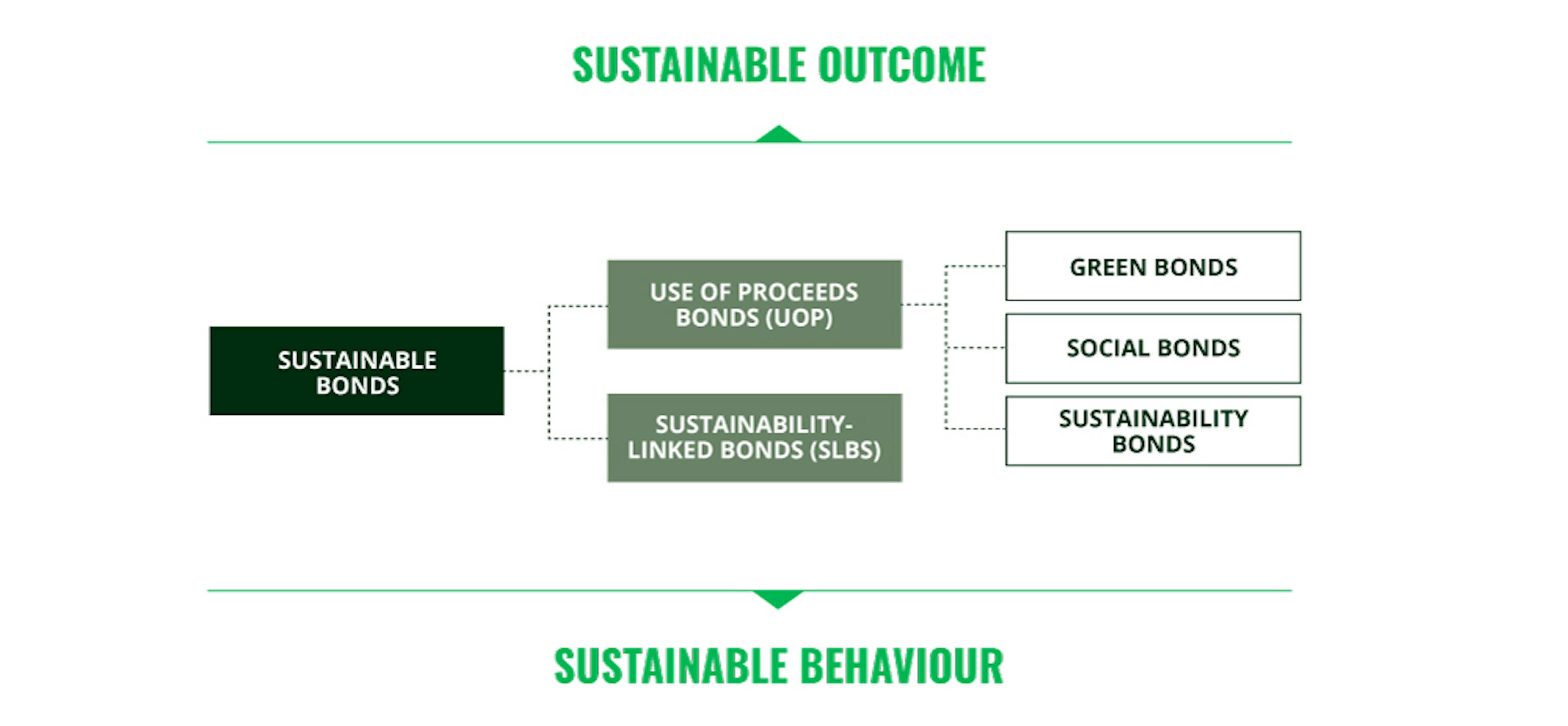

Used interchangeably with other terminologies such as “GSS+ bonds” (Green, Social, Sustainable and other labelled bonds) or “ESG bonds”, sustainable bonds are debt securities issued by public or private entities which integrate ESG considerations either through:

A “Use of Proceeds” approach (for UoP bonds): where the issuer commits to use the proceeds raised for a defined environmental and/ or social project. Under this category we mainly find green, social and sustainability bonds. Blue and transition bonds also fall under this category.

Sustainability targets (for SLBs): the proceeds raised are used for general corporate purposes and are not ring-fenced to any specific environmental and/ or social project. However, at the time of the issuance, the issuer chooses one or several sustainability “Key Performance Indicator(s)” (KPI) and “Sustainability Performance Target(s)” (SPT) which it commits to achieve by a “target observation date”. If the issuer misses the SPT, it is, most often, penalised by the triggering of a “coupon step-up” or “premium” for the rest of the life of the bond.

Are sustainable bonds here to stay?

We believe that sustainable bonds can play an important role in contributing to the allocation of capital towards defined environmental and/ or social goals (for UoP bonds) as well as in incentivising issuers to improve their behaviour by linking the cost of financing to sustainability commitments (for SLBs).

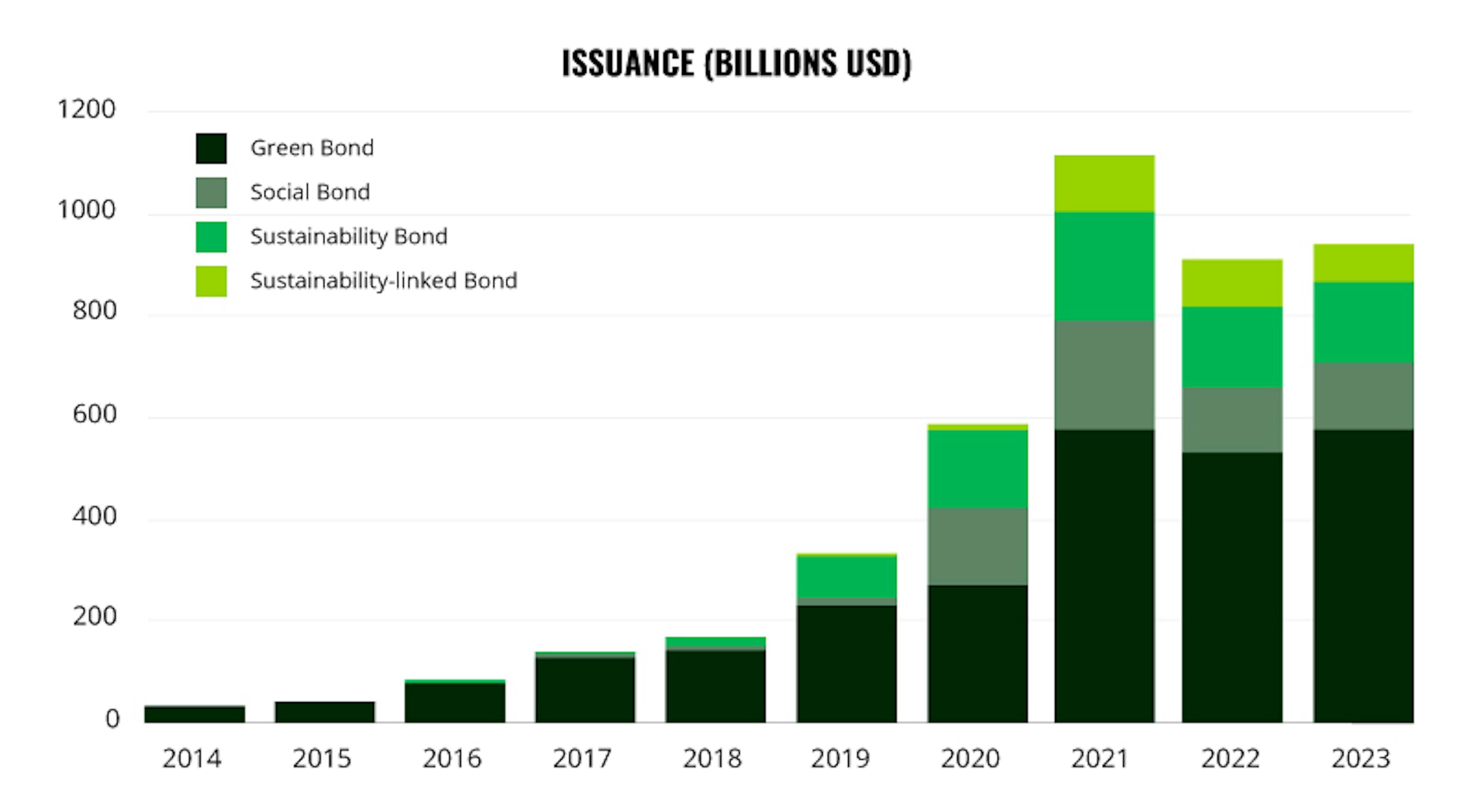

As indicated below, 2021 has so far been the peak year for the issuance of sustainable bonds. In 2023, we have observed a slight increase compared to 2022 (3%1), which experienced a significant drop compared to the high levels seen in 2021.

Global issuance of sustainable bonds:

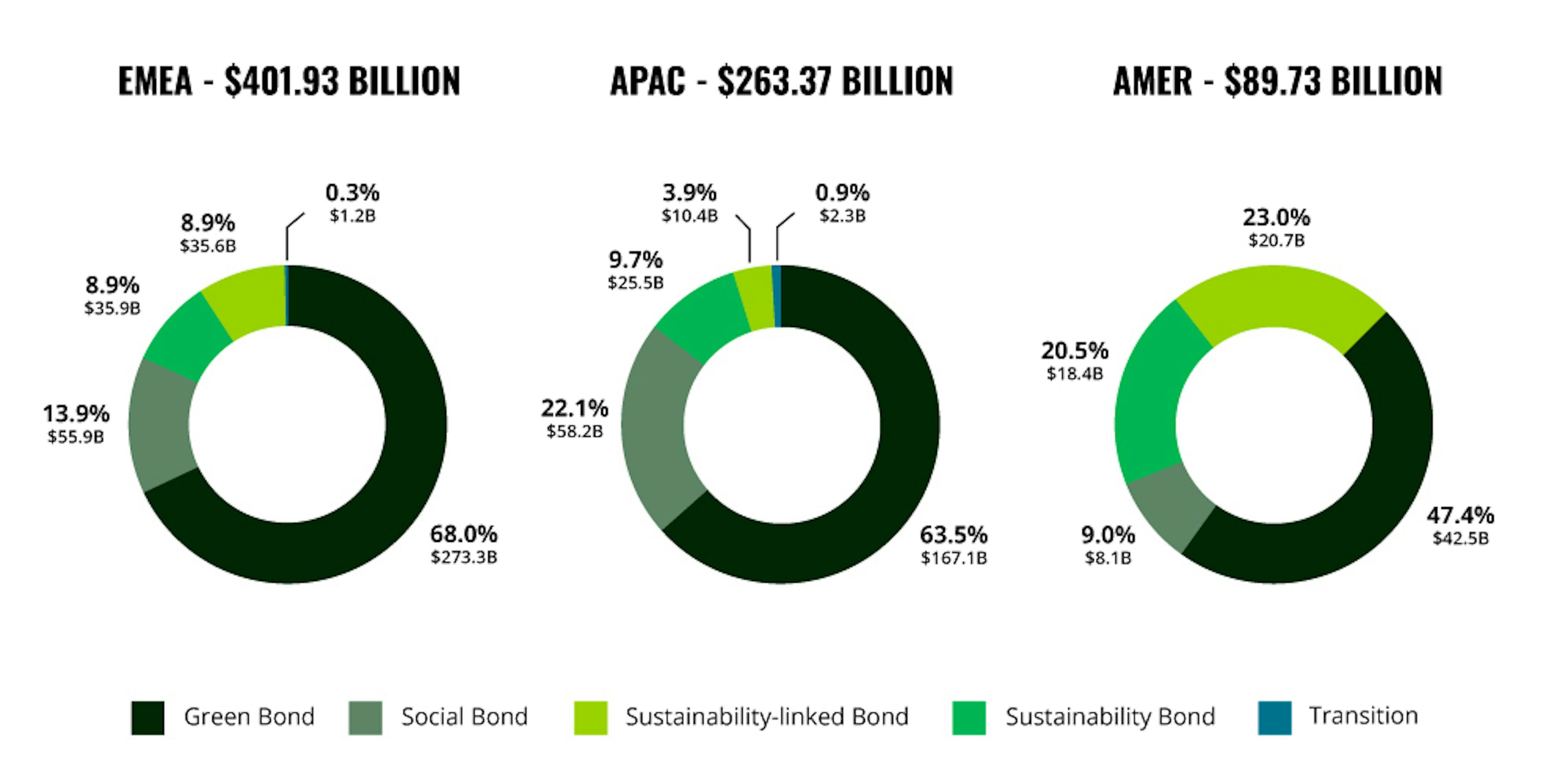

2023 data highlighted a record issuance of use of proceeds green bonds, which dominated issuance in EMEA, APAC and America and a large decrease in issuance volumes of SLBs.

According to Bloomberg, green bond sales from corporates and governments, climbed to USD 575 billion, a step up from 2022, beating 2021’s USD 573 billion figure. SLBs saw the largest decrease in issuance volumes in 2023, down 22% from the previous year, with USD 68 billion.

Issuance of sustainable bonds by region:

Our conviction in sustainable bonds

We believe that the issuance of sustainable bonds will continue in the future, considering the following factors:

There is a growing interest from investors, including Carmignac, who are increasingly incorporating ESG considerations into their investment strategies in response to client demand and in alignment with their own investment strategies;

Regulators are intervening to ensure the re-allocation of capital towards sustainability goals

Issuers continue to seek to demonstrate their commitment to sustainability considerations in their strategies, driven by regulators, investors, and other stakeholders.

While we see the development of sustainable bonds as a positive development, we must also recognise the imperfections of these thematic debt instruments. The market of sustainable bonds remains partly unregulated (except for green bonds taking into account the recent developments around the European Union Green Bond Standard or “EU GBS”) and therefore it is important that investors exercise sufficient diligence to ensure that the sustainability credentials of the instrument they invest in meets their expectations.

Sustainable Investing: Our conviction

Our mission is to create value for our clients and positive outcomes for the society and the environment by embedding Environmental, Social and Governance (ESG) considerations into our investment process and by using our voice as an active owner.Discover our approachRelated articles

Carmignac receives the ‘Label ISR’ for five additional funds

Marketing Communication. Please refer to the KID/KIID/prospectus of the fund before making any final investment decisions.

The decision to invest in the promoted fund should take into account all its characteristics or objectives as described in its prospectus. This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. The information contained in this material may be partial information and may be modified without prior notice.

Access to the Funds may be subject to restrictions regarding certain persons or countries. The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA. The Management Company can cease promotion in your country anytime. The risks, fees and ongoing charges are described in the KIID/KID. The Funds’ prospectus, KIDs, KIIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management Company. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. Investors have access to a summary of their rights in English at section 6 of "regulatory information page" on the following link: https://www.carmignac.com/en_US.

Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon.

UK: This document was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement of 10/06/2013).

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35 Investment management company approved by the AMF Public limited company with share capital of € 13,500,000 - RCS Paris B 349 501 676

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel : (+352) 46 70 60 1 Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF - Public limited company with share capital of € 23,000,000 - RC Luxembourg B 67 549