Flash Note

Why choose to invest your savings in a diversified fund?

- Published

-

Length

4 minute(s) read

Diversified funds, also known as mixed funds, offer an opportunity to invest in multiple financial asset classes (equities, bonds, currencies, etc.) and so they better diversify the risks borne by the investor.

There are many ways to grow your savings. The most direct is to invest your money by purchasing a financial asset (such as a share) and managing your investment over time (keeping your share, buying another, selling it). But this can be time-consuming, and not everyone has the necessary knowledge and access to financial markets. For example, it would be risky for European savers to lend money to Asian companies they don’t know. That’s why it can be more effective to invest your money in funds managed by professionals.

Some of these funds are described as “diversified” or “mixed”, meaning that they provide investors with diversification opportunities. What are these funds? How do they work? What are the potential benefits of investing your savings in one? These are all legitimate questions for investors. The information below may help to clear up some of the confusion.

What is a mixed fund?

A fund that combines several financial asset classes. Unlike funds that specialise in a single category of financial product (e.g. equity funds that only invest in the equities of listed companies), funds are described as “diversified” when they invest in multiple categories (or classes) of financial asset: equities, bonds, currencies, money market instruments, commodities, etc. These assets tend not to follow the same trajectory over time, as their prices may depend on different factors.

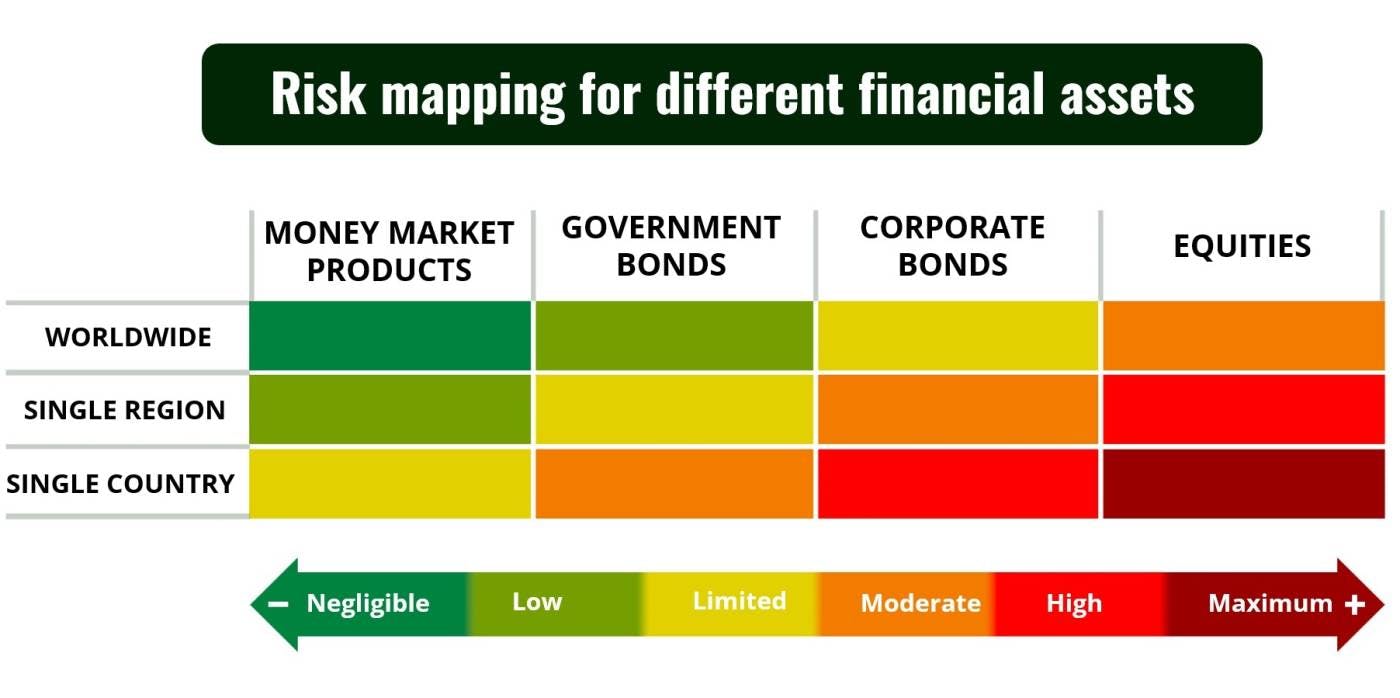

Mixed funds therefore allow you to combine multiple financial assets with differing risks within the same portfolio:

assets deemed low risk: such as money market products, or short-term debts issued by companies in the form of commercial paper, deposit certificates, etc. The risk associated with such debts is limited because they will soon be repaid, but the returns on offer are quite low as a result;

riskier products: such as equities or commodities, which are more volatile (meaning that they experience larger price variations) but offer higher potential returns.

-

Good to know: The return on a financial investment compensates the investor for the risk taken. Risky financial products may perform better than low-risk assets, but they may also expose the investor to a greater level of risk – including the risk of capital loss.

Why invest in a mixed fund?

To better manage risk. Mixed funds embody a basic principle of portfolio management – not putting all your eggs in one basket. The rationale for using more investments, and a wider range of asset classes, is not just to target a better risk/return profile1. The aim is also, above all, to spread financial risk.

Investors can seek to limit their risk of capital loss by combining risky and less risky assets within a single portfolio. When risky assets decline in value, the decrease may be fully or partially offset by an increase for other assets in the portfolio. For example, the capital loss generated by a share may be offset by the interest received on a bond. In other words, mixed funds help to mitigate the effect of risky assets’ volatility.

-

Good to know: When you invest in a fund, you entrust your money in a portfolio manager who will make changes (buy or sell assets) on the basis of opportunities and risks in financial markets. With support from a team of financial analysts and economists, the portfolio manager constantly assesses whether the composition of the portfolio is suitable in light of market developments, while also bearing in mind the fund’s objectives and the level of risk-taking permitted. The latter is defined in the key information document (KID). The fund’s risk profile is recalculated on a regular basis and investors know how much risk their capital is exposed to at all times.

Find out how we manage risk

How to choose a mixed fund

The diversification strategy involves switching between different asset classes. But before you can do that, you need to see whether you are a cautious, balanced or dynamic investor by determining your investor profile.

This overview of your situation, age, income, investment horizon, risk appetite and aims serves as a basis on which to choose the best fund for you, which may be defensive, adventurous or somewhere in between.

The category your mixed fund falls into affects the weighting of the various asset classes. A cautious mixed fund will contain more low-risk assets than risky assets. For example: 45% government bonds, 35% money market products and 20% equities. Conversely, a dynamic fund may invest 20% of its assets in corporate bonds, 40% in equities and 40% in commodities.

-

Good to know: Some mixed funds are referred to as “flexible”, meaning that they are more responsive to factors such as financial market fluctuations (rises and falls) and economic variations in particular geographical regions. The portfolio manager may adjust the portfolio’s exposure to financial asset classes, sectors and/or geographical regions on the basis of set criteria and the fund’s strategy with the aim of achieving steady returns greater than those offered by the standard management process.

What Carmignac offers

Carmignac has developed a range of mixed funds designed to meet the needs of clients wishing to invest over the long term. As a pioneer in this field, Carmignac offers multiple products underpinned by an approach that is global, flexible and complementary in terms of financial assets and strategy.

1High profits from an investment are associated with greater risk and, conversely, safe investments are associated with low risk. Accordingly, investors looking to make their portfolio more profitable must be willing to take on more risk.