Funds in Focus

Bond Fund of the Month: Carmignac P. Unconstrained Euro Fixed Income

- Published

-

Length

4 minute(s) read

Since March 10th, 2021, the new name of Carmignac Portfolio Unconstrained Euro Fixed Income is Carmignac Portfolio Flexible Bond.

Carmignac Portfolio Unconstrained Euro Fixed Income is an actively managed Fund aiming to capture global bond market opportunities with currency risk systematically hedged. The Fund is a core allocation for investors and aims to recreate the role fixed income investments used to have by actively managing our bond allocation. Follow us now in the heart of our portfolio construction to discover our main fixed income convictions.

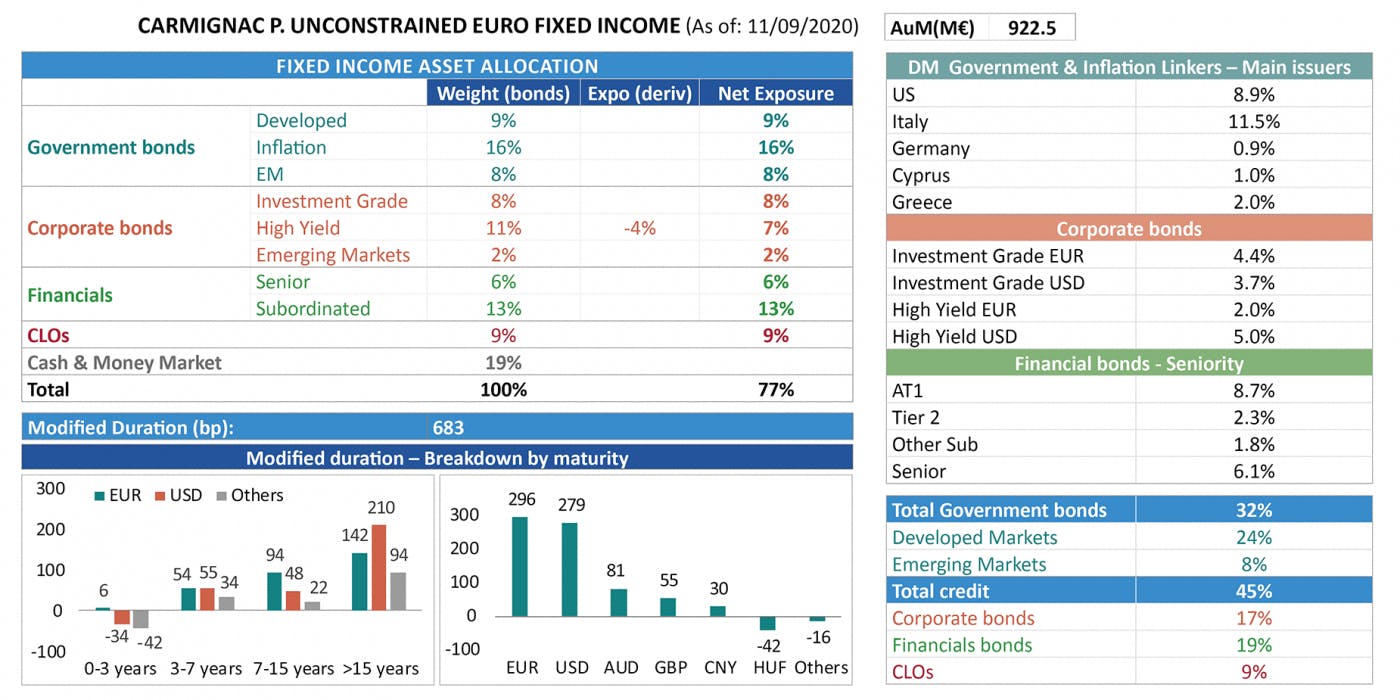

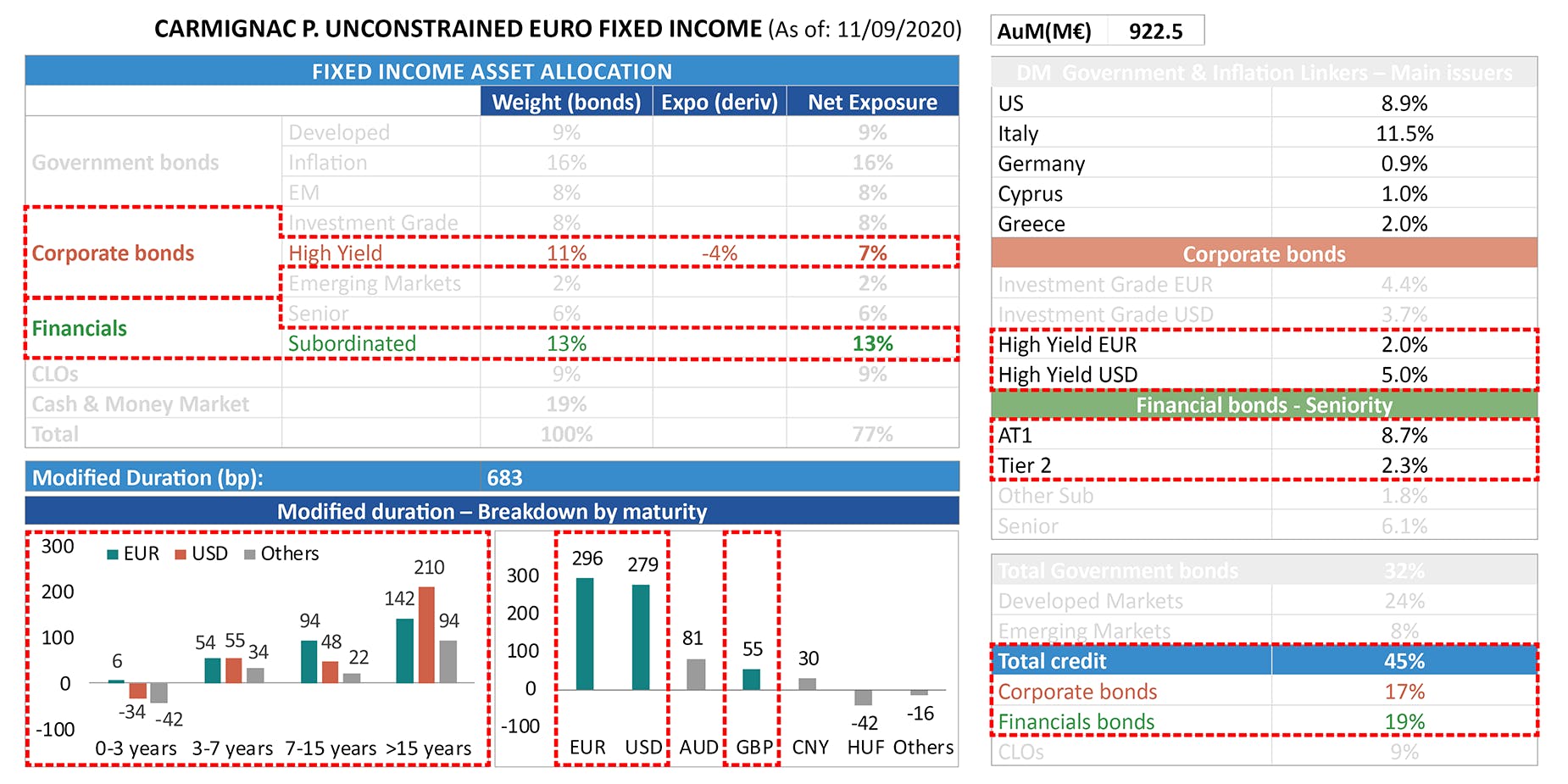

We use this table on a regular basis to explain the positioning of our Fund. Below you will find an explanation of our Portfolio Managers’ main current convictions and how to find and understand these positions through this positioning table.

-

Portfolio construction

We have decided to take some profits on certain segments of the credit market where the risk/reward profile has deteriorated (Investment Grade corporate bonds and senior financial debt). As a result, we have a reduced credit exposure of 45% compared to nearly 65% in July. By reducing our risky assets, we have also reduced our total modified duration, which remains at a high level to enable the portfolio to withstand risk-averse movements. If we stayed close to our maximum modified duration of 8 during the summer, we are now navigating in a range between 6.5 and 7.5. -

Table reading keys

As you can see in the table, on the right side, the reduced amount of IG investments and senior financial bonds after profit taking. As a result, our level of exposure to the credit market decreased to 45% in the bottom right (VS 65% in July). A reduction in the overall modified duration now at 683 bps compared to nearly 800 bps in July. More details with the two graphs below, the reduction was mainly on the EUR yield curve (296 bps vs. more than 400 bps in July) and especially on the 7-15 years part.

-

Portfolio construction

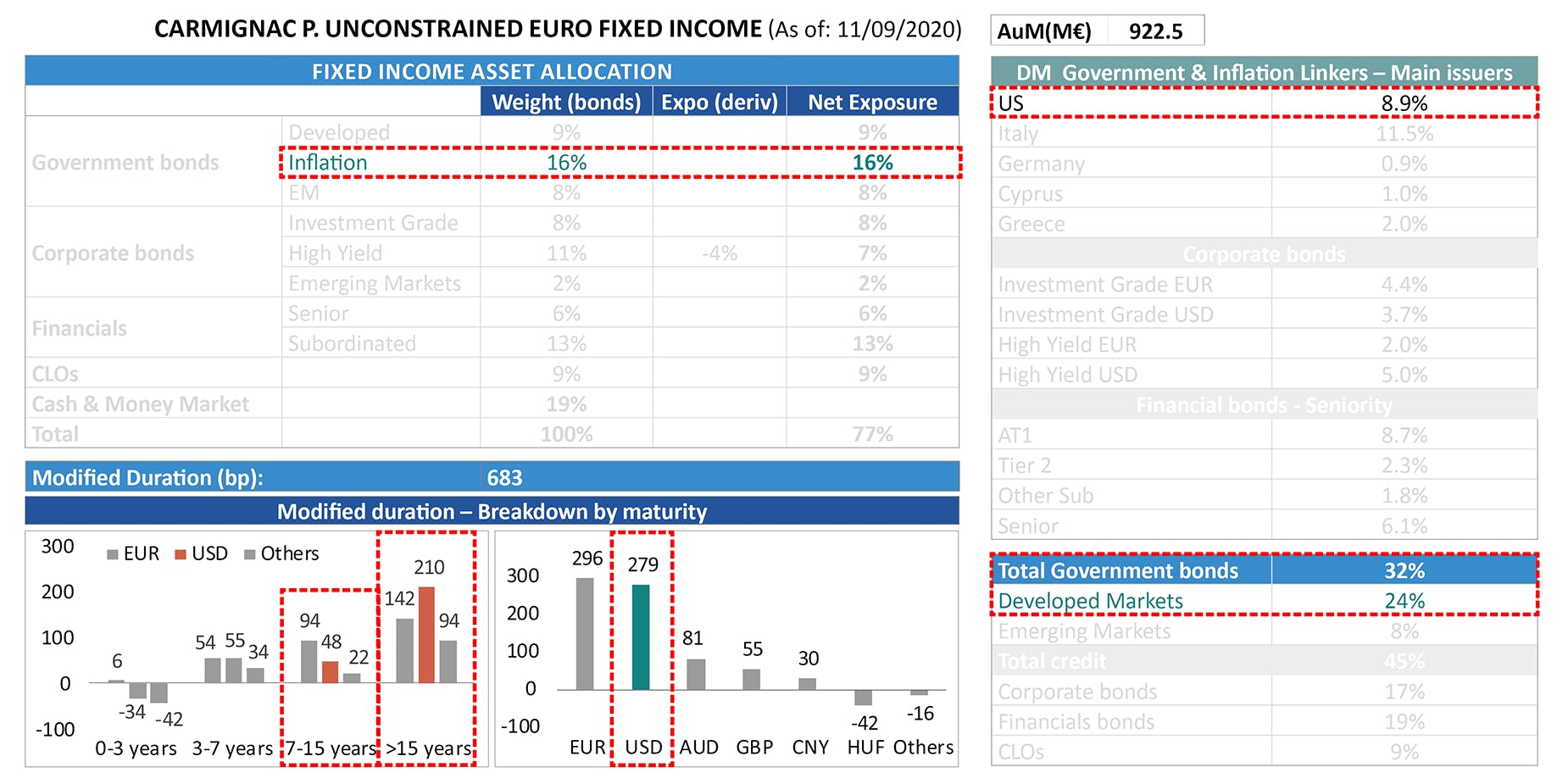

We have a high duration on the US yield curve through notably inflation-indexed bonds, which should be supported by an increasingly accommodating Fed and by the credibility of the US monetary institution to achieve its inflation objectives. Note that we favor the long end of the curve as we believe that the real yield curve, which is currently very steep, should flatten. -

Table reading keys

Thus, we have almost 9% of US linkers, which can be seen in the table on the top right. US linkers that can be found in the main table in the 16% of the "linkers" category, but also in the bottom right-hand corner in the Developed Markets part since they are “US” linkers. These US linkers also contribute to the Fund's modified duration, which is shown in both diagrams. On the left, as we are dealing with 10-year and 30-year maturities, they provide duration in the most important maturity buckets. On the right, they add duration to the US yield curve (279 bps).

-

Portfolio construction

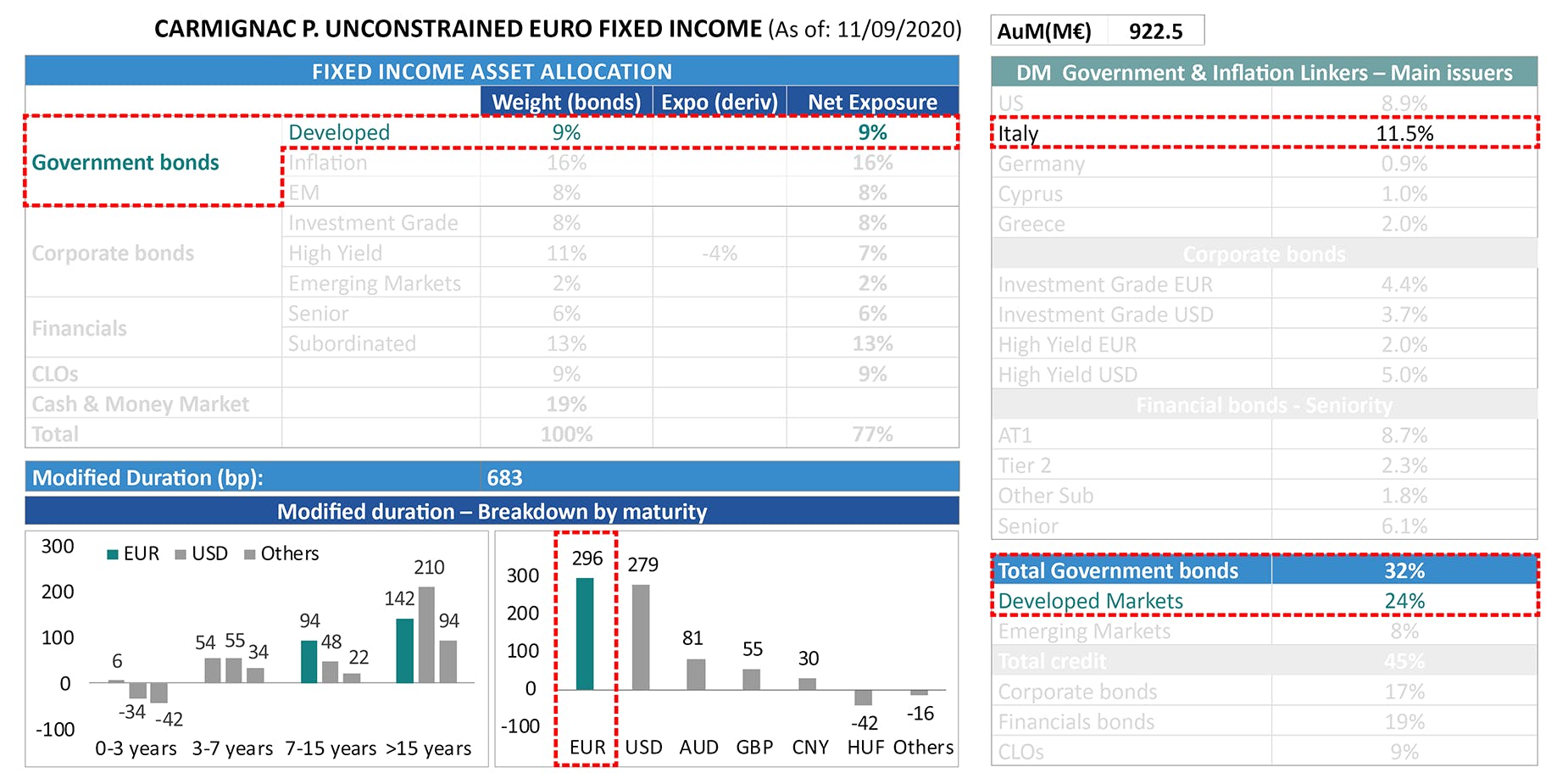

In Europe, we have decided to replace our long positions on German real rates with Italian nominal rates. Indeed, we believe that the ECB will favor the region’s financial stability by increasing its purchasing volume, for example, with the objective of keeping the rates of peripheral countries at low levels. -

Table reading keys

Our exposure to Italian debt of just over 10% is quite visible in the table at the top right, but also in the main table among the "Developed" category and at the bottom right in the section of DM sovereigns (24%). These Italian sovereign bonds also contribute to the Fund's modified duration, which is shown again in both diagrams. On the left, as we are dealing with 10-year and 20-year maturities, they provide duration in the most important maturity buckets. On the right, they add duration to the EUR yield curve (296 bps).

-

Portfolio construction

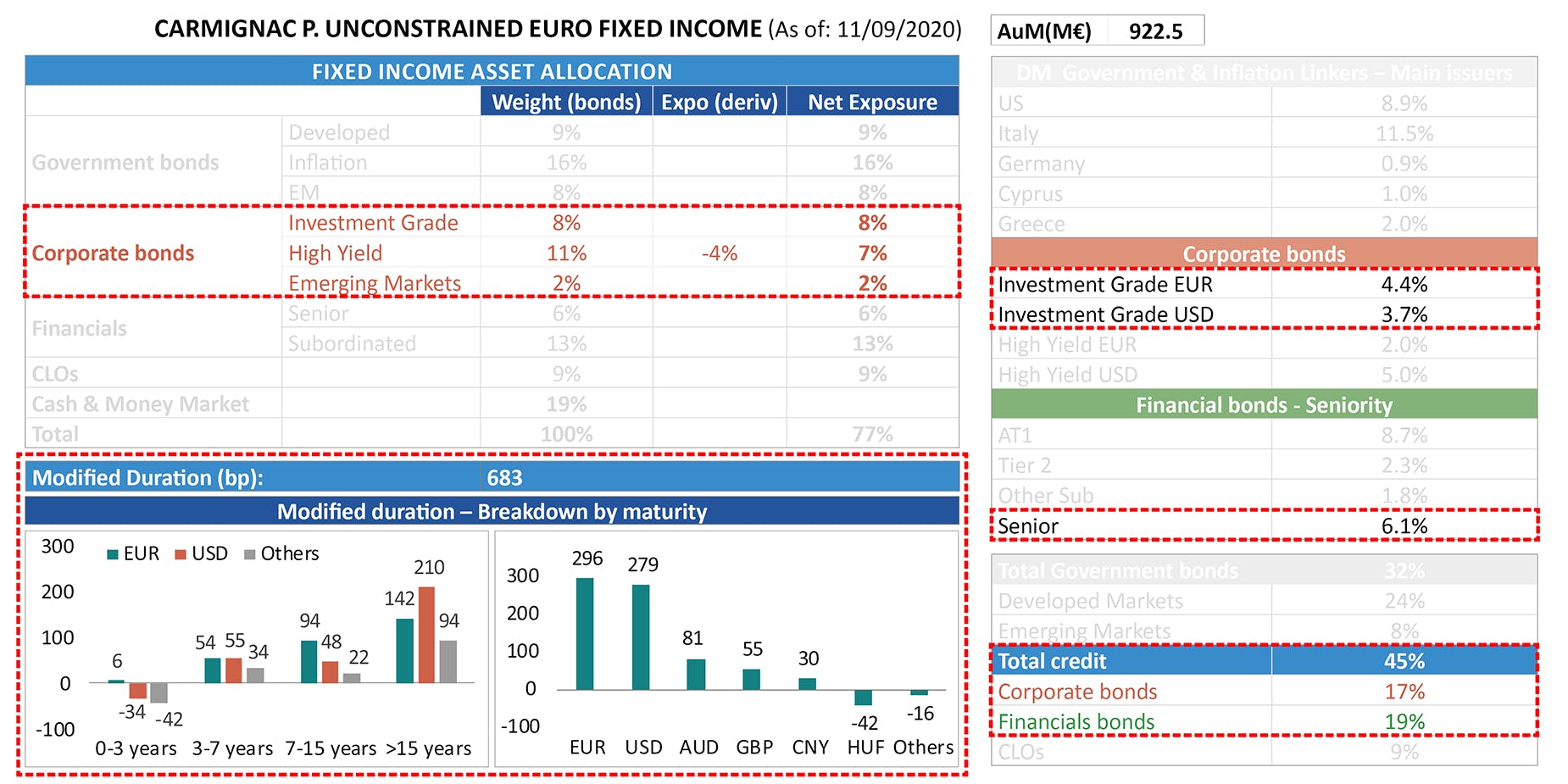

Even reduced, we maintain a strong conviction on credit, with a positioning that is now more focused on the "high yield" names and financial subordinated bonds, which still offer the potential for spread tightening as well as an interesting level of carry. It should be noted that these two segments of the credit market are still lagging behind the other constituents of the credit market since the beginning of the year. -

Table reading keys

Our credit exposure more concentrated on high yield investments and financial subordinated bonds is reflected in the main table with exposures of 7% and 13% respectively but with even more granularity on the right side. We obviously find these convictions within our overall credit exposure in the bottom right-hand corner (45%). These credit segments also contribute to the Fund's modified duration, which is shown in both diagrams. On the left, we see we are dealing with all maturities. On the right, they add duration to the US, EUR and GBP yield curves.

Carmignac Portfolio Flexible Bond A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

Potentially lower return Potentially higher return

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CREDIT: Credit risk is the risk that the issuer may default.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

The Fund presents a risk of loss of capital.